Trade Review and Advice for Trading the British Pound

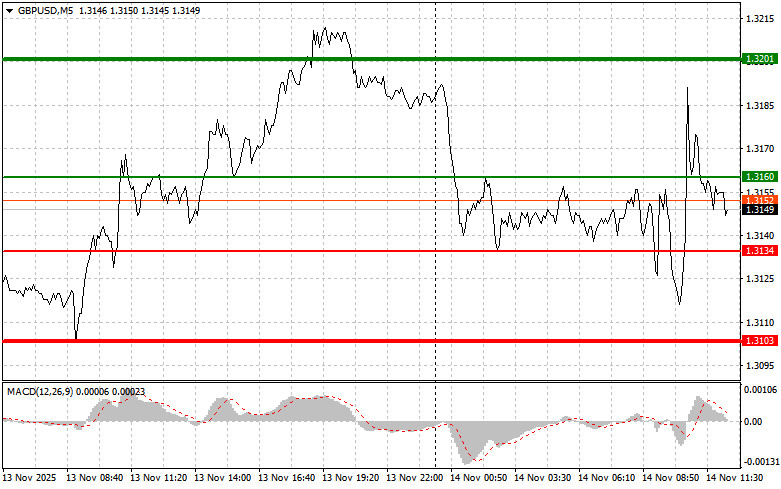

The test of the 1.3134 price occurred when the MACD indicator had just begun moving downward from the zero line, which confirmed a correct entry point for selling the pound. As a result, the pair declined by 20 points.

The pound continues to show high volatility, directly linked to issues surrounding the UK's budget for next year. Uncertainty regarding tax policy, economic stimulus measures, and plans to reduce the budget deficit is putting pressure on the sterling, making investors nervous and prompting them to seek more stable assets. The situation is further complicated by high inflation, which, despite the Bank of England's efforts, has yet to show a steady downward trend.

Statements today from Federal Reserve officials about pausing the rate-cutting cycle may help the dollar strengthen against the pound. However, far more important would be fundamental statistics—which are absent today—so significant movement in GBP/USD is unlikely.

Regarding the intraday strategy, I will rely mostly on Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy the pound today upon reaching the entry point near 1.3160 (green line on the chart) with a target of rising to 1.3201 (thicker green line on the chart). Around 1.3201, I will exit long positions and open short positions in the opposite direction (expecting a reversal of 30–35 points from the level). Pound appreciation today can be expected within the current upward trend in the pair.Important! Before buying, make sure the MACD indicator is above the zero line and only beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3134 price at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 1.3160 and 1.3201 may then be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price breaks below 1.3134 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3103 level, where I will exit sales and immediately open buys in the opposite direction (expecting a 20–25 point reversal from the level). Downward pressure on the pound will return if the Federal Reserve takes a hawkish stance.Important! Before selling, make sure the MACD indicator is below the zero line and only beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3160 price at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3134 and 1.3103 may then be expected.

Chart Legend:

Important

Beginner traders in the Forex market must make entry decisions very cautiously. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you may very quickly lose your entire deposit—especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear trading plan like the one I provided above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for an intraday trader.

RÁPIDOS ENLACES