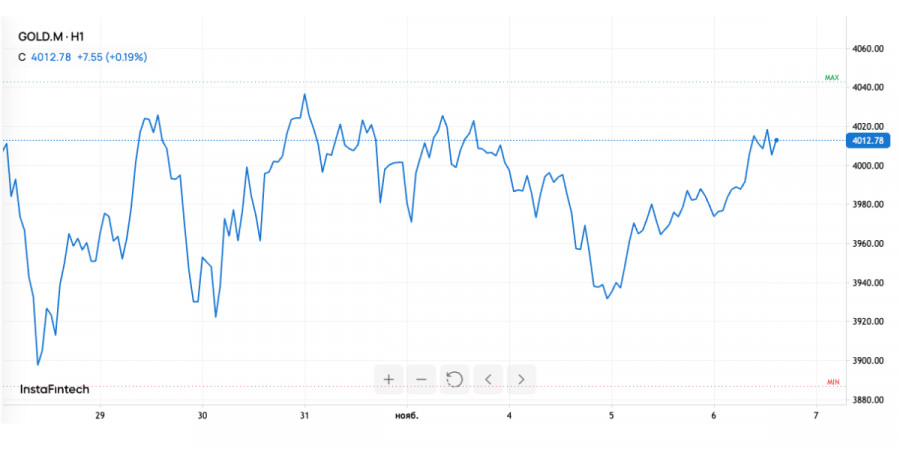

The global gold market completes the first week of November in a zone of confidence. After a brief pause, quotes have once again consolidated around the key level of $4000 per ounce. This recovery has been aided by a weakening dollar and overall uncertainty surrounding the U.S. economy, which is experiencing the longest government shutdown in history. Against this shaky fundamental backdrop, gold is once again proving itself to be a reliable safe-haven asset, though not without pressure from riskier markets.

Over the course of the day, gold gained about 0.4%, with December futures reaching $4005 per ounce. The dollar's 0.2% drop made the metal more attractive to foreign investors. This is a classic scenario: when the dollar loses ground, gold receives an additional impetus.

Political factors have also supported the quotes. The ongoing U.S. government shutdown has paralyzed some government services and muddled the economic picture. Against this backdrop of uncertainty, market attention shifted to private-sector data, which proved unexpectedly strong. In October, private companies created 42,000 jobs instead of the expected 25,000, while the ISM services activity index rose to an eight-month high.

At first glance, this is positive for the economy, but not for gold. Strong statistics reinforced the belief that the Federal Reserve will not rush to lower rates further. This means less cheap money, fewer incentives, and, as a consequence, pressure on precious metals.

Despite a strong foundation in the form of a weak dollar and instability in the U.S., gold is finding it increasingly difficult to maintain its growth. The reason is the changing sentiment in financial markets. After the declines of October, investors have started returning to stocks and riskier assets, which has weakened interest in gold as a "safe haven."

The Federal Reserve's rhetoric is exerting additional pressure. Several officials hinted that the last rate cut this year could be the final one, and that further easing will be slow. Although some central banks still speak of the need to lower rates in the future, the overall tone remains "hawkish."

Nevertheless, high inflation prevents a complete abandonment of gold. Even amid moderately rising bond yields and a stock market revival, investors continue to hold a portion of their capital in precious metals. This provides gold with solid support at current levels.

Gold remains nearly 9% below the October peak of $4381 per ounce, but the balance between economic risks and central bank policies keeps the market resilient. As long as the dollar does not start to strengthen steadily and the Fed does not give a clear signal of new hikes, the metal is unlikely to dip below $3950–$ 3980.

On the other hand, to return to the highs, fresh reasons are needed: either a sharp deterioration in economic data or a deepening crisis surrounding the U.S. government. Otherwise, gold will likely move within a sideways range of $3950–4050, maintaining its status as a protective but not a growing asset.

Gold continues to serve as a barometer of anxiety in global markets. The weakening dollar and chaos in American politics support its price, but strong data and moderate rate expectations curb its growth.

Currently, the market is in equilibrium: investors hold gold not for profit, but for peace of mind. As long as uncertainty in the U.S. persists, the metal is unlikely to relinquish its position at $ 4,000—a symbolic line between fear and confidence.

RÁPIDOS ENLACES