Praha – Průměrná sazba hypoték na počátku května poprvé od jara 2022 klesla pod pět procent, proti předchozímu měsíci se snížila o 0,05 procentního bodu na 4,96 procenta. Vyplývá to z údajů Swiss Life Hypoindexu, který se zpracovává na základě nabídkových sazeb na začátku každého měsíce. Metodika odráží aktuální průměrnou nabídkovou sazbu hypotečního úvěru pro 80 procent hodnoty nemovitosti.

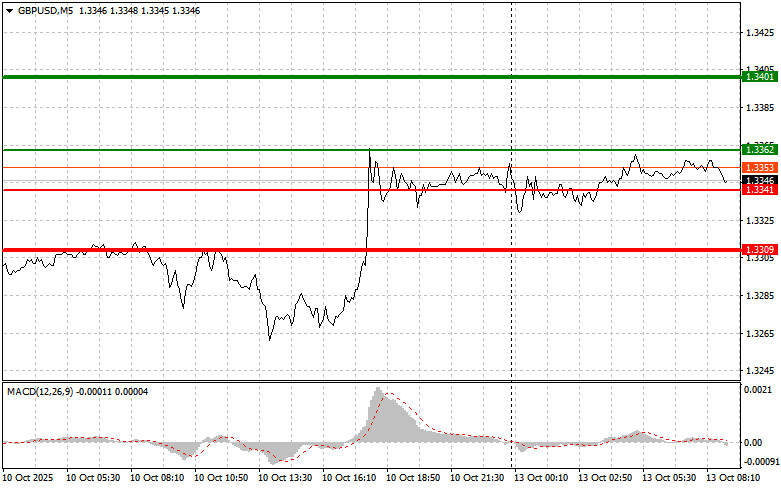

A test of the 1.3310 level occurred at a moment when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential.

The British pound rose sharply, while the U.S. dollar declined following Donald Trump's renewed consideration of implementing 100% tariffs against China. Waves of panic swept through financial markets, forcing investors to hastily reassess their strategies.

Trump's statements, as unexpected as a bolt from the blue, immediately drove the dollar down, exposing its vulnerability in the face of geopolitical uncertainty. The British currency—seemingly unaffected directly by the U.S.–China conflict—capitalized on the situation and demonstrated unexpected resilience.

However, the optimism observed in currency markets may be short-lived. Further escalation of the trade war between the U.S. and China may have unpredictable consequences for the global economy, including the United Kingdom.

No economic reports are expected from the U.K. today, which makes the speech by Megan Greene particularly important. Her remarks on inflation risks, economic growth prospects, and the potential for further interest rate increases could influence both the short-term dynamics of the pound and broader market sentiment.

Investors and analysts will be closely watching for any signs pointing to the Bank of England's intentions regarding monetary policy.

As for the intraday strategy, I will rely primarily on scenarios №1 and №2.

Important: Beginner forex traders should be extremely cautious with entry decisions. Before major fundamental reports, it's best to remain out of the market to avoid exposure to abrupt price swings. If you do decide to trade during high-impact events, always place stop-loss orders to minimize losses. Without them, your account balance can deplete quickly, especially if you neglect proper money management and trade large volumes.

And remember, successful trading requires a clear plan—like the one presented above. Spontaneous decision-making based solely on the current market situation is an inherently losing strategy for intraday traders.

RÁPIDOS ENLACES