There aren't many macroeconomic reports scheduled for Friday, and only one of them is truly important – the ISM Services PMI in the U.S. In addition to this index, we'll also see second estimates of services PMIs for Germany, the UK, and the EU, as well as the Producer Price Index in the EU. However, these reports are of secondary importance. Also, the NonFarm Payrolls report and the unemployment rate were supposed to be released today, but most likely that won't happen due to the U.S. government "shutdown" that began on October 1. Therefore, all attention today will be on the ISM Services PMI.

Several key fundamental events are scheduled for Friday. Most notably, speeches from European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey. Lagarde may comment on the latest inflation report, while Andrew Bailey may provide guidance on the next steps for the Bank of England's monetary policy. Both speeches are potentially important.

There will also be several speeches from Fed representatives, who may answer the question of what the central bank's decisions will be based on if no labor market and unemployment reports are available. The next Fed meeting is scheduled for late October, by which time the shutdown may already be over. However, October data could end up being "distorted" due to the shutdown. Thus, extra attention will also be on Fed officials.

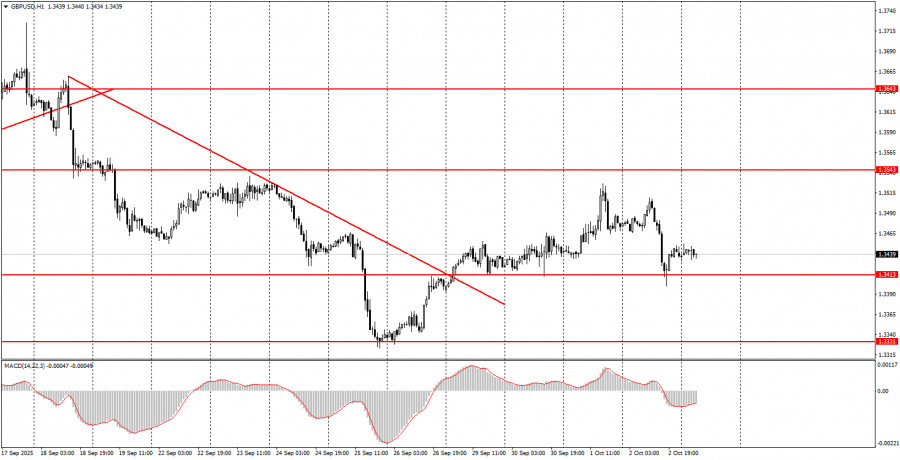

On the last trading day of the week, both currency pairs may continue moving upward. The British pound has ended its downward trend, which suggests that the euro is also likely to have completed its downtrend (although it hasn't yet broken the trendline). The euro has a trading zone at 1.1745–1.1754, while the pound has entry zones at 1.3466–1.3475 and 1.3413–1.3421.

RÁPIDOS ENLACES