The GBP/USD currency pair also easily and calmly returned to its original positions on Thursday, only to continue its decline. As we mentioned in previous articles, it is wise to reserve judgment for now and not rush to conclusions or entirely rethink the technical picture. The dollar may show some growth, but under current conditions, any rise in the dollar is likely to be only corrective. The Fed's monetary policy stance nearly perfectly matched traders' expectations, so in essence, there was no fundamental reason to sell or buy. Jerome Powell took the same stance he always does: Fed decisions will depend entirely on macroeconomic data, and any rate decisions will be made on a meeting-by-meeting basis, with no explicit roadmap.

Powell did not deny that the Fed could reduce the key rate twice more before the year's end, but he also did not say this was now the base scenario. We also noted that if the labor market starts to recover soon and inflation continues to accelerate, the Fed will again be forced to pause. Thus, no new conclusions can be drawn after the Fed's meeting. "Dovish" market expectations have, of course, increased, but they have remained high since the beginning of 2024, when traders expected seven rate cuts—barely managing to get just three. So, that's not really news.

The most important point is not actually related to the Fed meeting at all. We have to answer the question: what should we expect from the dollar if the Fed is lowering rates while the ECB and the Bank of England are on hold, given that the dollar crashed in the opposite scenario? The answer is simple: sooner or later, the US currency will continue to depreciate; the only question is how fast, and that will depend on the pace of monetary easing.

Now to the BoE, which did not surprise traders at all. The key rate remained unchanged, and the voting among Monetary Policy Committee members was exactly as expected—7 to 2. With inflation in the UK having doubled over the past year, there's no reason to expect any monetary policy easing from the British central bank in the near future. The only noteworthy decision was the reduction of the target level for securities held on the balance sheet, from £100 billion per year to £70 billion. What does that mean?

It means the BoE will be selling Treasuries and other securities at a slower pace than before, and will thus be draining excess liquidity from the market more slowly. In principle, this decision doesn't change much, as the Bank is still fighting high inflation by this method. The more money is in circulation, the faster prices rise. In any case, the aim is to reduce the money supply. As with the Fed, we advise against making hasty conclusions about the market's reaction and to wait until traders fully price this in.

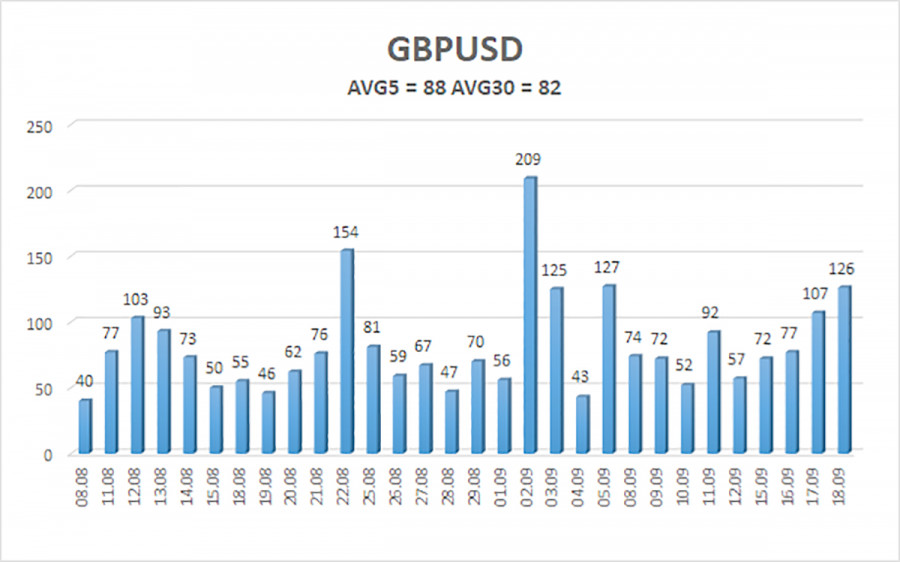

The average volatility for GBP/USD over the last five trading days is 88 pips, which is considered "average" for this pair. Therefore, on Friday, September 19, we expect movement within the range limited by 1.3454 and 1.3630. The long-term linear regression channel is pointing upwards, indicating a clear upward trend. The CCI indicator has once again moved into oversold territory, warning once more of a possible trend resumption.

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

The GBP/USD currency pair aims to continue its upward trend. In the medium term, Donald Trump's policies are likely to continue putting pressure on the dollar, so we do not expect sustained growth from the dollar. Thus, long positions with targets at 1.3672 and 1.3733 remain much more relevant if the price is above the moving average. If the price is below the moving average, short trades can be considered on a purely technical basis. From time to time, the US currency shows corrections (as now), but for a real trend reversal, it will need clear signs of an end to the global trade war or other major positive global factors.

RÁPIDOS ENLACES