US equity indices closed higher yesterday, with the S&P 500 up 0.47% and the Nasdaq 100 adding 0.44%. The Dow Jones Industrial Average gained 0.11%.

Indices continued to notch record highs, while gold rose to a new peak as investors maintained bets that the Federal Reserve will ease monetary policy this week. The committee's two-day meeting begins today, with a rate decision to follow.

Market sentiment is fueled by expectations that the Fed—faced with slowing economic growth and persistent inflation—may reconsider its policy stance. Some analysts are even suggesting the possibility of a more aggressive rate cut in the near future, which would be a strong catalyst for equities and alternative assets such as gold. Weak labor data and lower consumer activity could intensify pressure on the Fed to act more boldly.

The MSCI All Country World Index advanced 0.1%, marking its 10th straight session of gains—the longest rally in more than four years. Asian indexes climbed 0.7% to a record, setting up for their best streak in nearly five years. S&P 500 futures rose 0.1% today after the index closed at an all-time high, while European equity futures also edged higher.

Gold hit another fresh high as the dollar slipped. Treasury yields stabilized as investors awaited weak US retail sales data. The yen strengthened against the dollar, partly due to Japanese Agriculture Minister Shinjiro Koizumi entering the race for leadership of the ruling Liberal Democratic Party.

On Monday, tensions escalated between the Trump administration and the Federal Reserve after an appeals court declined to allow the White House to temporarily remove Fed chief Lisa Cook from her post.

Meanwhile, President Donald Trump announced that he would hold talks with Chinese leader Xi Jinping on Friday after US and Chinese officials reached a framework agreement to allow TikTok to continue operating in the US.

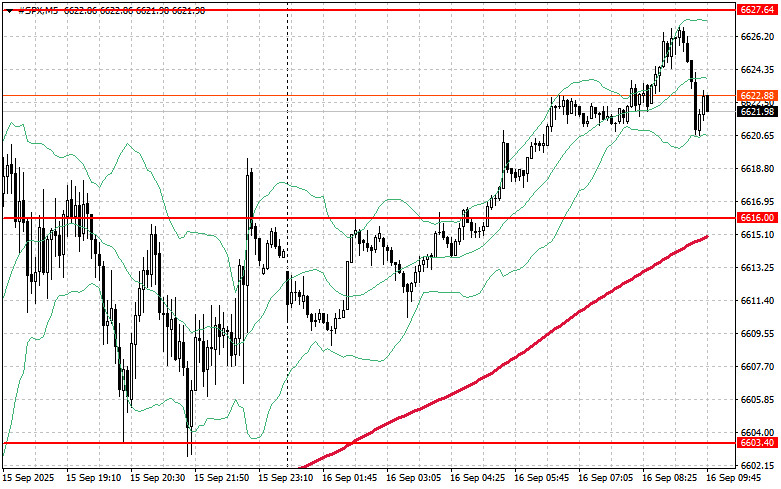

From a technical standpoint, today's main task for S&P 500 buyers will be to break above resistance at $6,627, which would allow for further growth and open the door to $6,638. Holding above $6,648 would be equally crucial, further consolidating bullish positions. On the downside, if risk appetite fades, buyers will need to defend $6,616. A break below this level would quickly push the index back to $6,603 and open the way to $6,590.

RÁPIDOS ENLACES