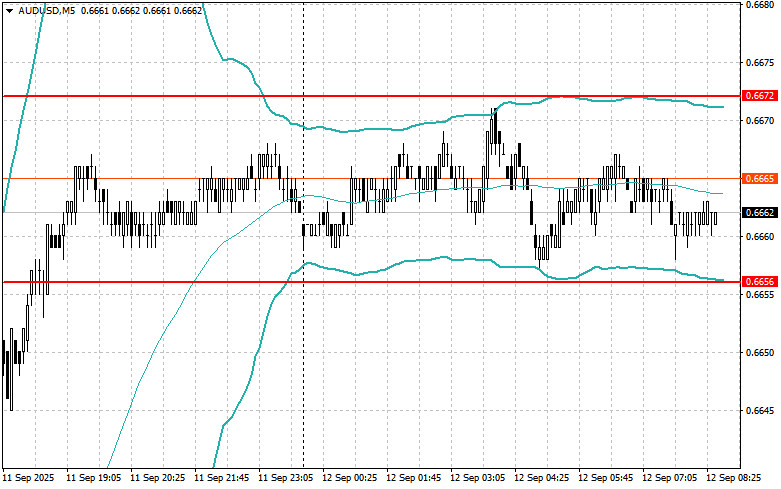

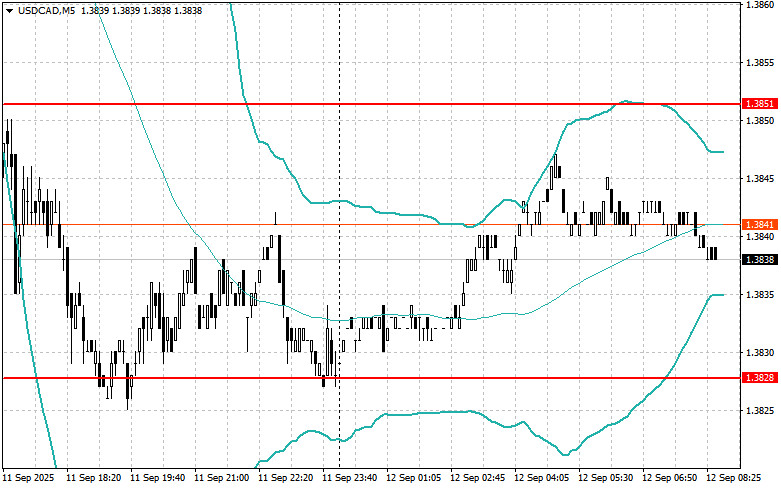

The US dollar once again weakened against risk assets as traders increased their expectations of an interest rate cut next week.

Despite no rate cut yet, the US Consumer Price Index came in close to expert forecasts. The actual uptick was 0.4% versus a forecast of 0.3%. This kept pressure on the dollar and stimulated interest in the euro, the British pound, and other risk assets. The released data indicate a smooth rise in inflation, giving the Federal Reserve more room to maneuver.

Today, in the first half of the day, data is expected for Germany's and France's consumer price indices, Italy's unemployment rate, and a speech by Bundesbank President Joachim Nagel. Economists and traders eagerly await inflation reports from the eurozone's largest economies. Germany and France, as the engines of Europe, set the tone for price trends. If inflation beats expectations, the ECB could completely rule out rate cuts in this cycle, bolstering confidence in euro buying.

At the same time, Italy's unemployment will be closely watched, particularly given the country's debt issues and overall labor market instability in Europe. Comments from Bundesbank President Joachim Nagel are also of keen interest, as he is an influential voice on the ECB's Governing Council. His remarks on the economic outlook and monetary policy could significantly alter market expectations and thus move financial assets.

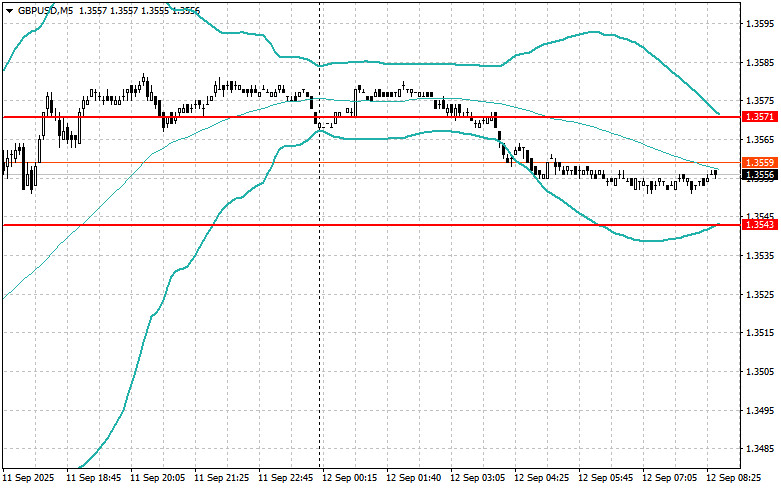

Regarding the pound, a series of important UK releases is due this morning. First will be GDP and industrial production figures, and the series will conclude with trade balance data. GDP figures will offer key insight into the overall state of the economy and its growth or contraction pace. Of particular interest will be GDP breakdowns by services, industry, and construction, highlighting which sectors are expanding or struggling.

Industrial production dynamics are a key measure of Britain's international competitiveness. An increase can signal rising demand for British goods abroad.

If data matches economist forecasts, it's better to use a Mean Reversion strategy. If data is notably above or below projections, Momentum strategies are preferred.

RÁPIDOS ENLACES