Čínské ministerstvo zahraničí požádalo všechny strany zapojené do plánovaného prodeje většiny přístavních operací společnosti CK Hutchison konsorciu vedenému společností BlackRock, aby „jednaly obezřetně“, informovala v pondělí státní agentura Xinhua.

Prodej hongkongského konglomerátu, který zahrnuje dva přístavy přiléhající ke strategicky důležitému Panamskému průplavu, se stal vysoce politizovanou záležitostí uprostřed rostoucího obchodního napětí mezi Spojenými státy a Čínou.

The Wall Street Journal s odvoláním na informované zdroje uvedl 16. dubna, že lodní impérium MSC, které je součástí konsorcia BlackRock (NYSE:BLK), jednalo o pokračování hlavní části dohody, zatímco spory ohledně dvou panamských přístavů budou řešeny zvlášť.

„Vzali jsme na vědomí příslušné zprávy,“ řekl mluvčí ministerstva zahraničí Guo Jiakun na pravidelném tiskovém brífinku, jak uvedla Xinhua.

Mluvčí také vyzval všechny strany, aby udržovaly plnou komunikaci s příslušnými čínskými úřady, dodala agentura.

Čínský nejvyšší tržní regulátor také v neděli reagoval na zprávu Wall Street Journal a uvedl, že situaci bedlivě sleduje a že se strany nemají pokoušet obejít antimonopolní kontrolu.

Apart from financial losses, the US has already incurred reputational costs. What about the trade agreements worth hundreds of billions of dollars that have been signed? After all, they also imply certain tariffs. What about retaliatory tariffs? Trump has stirred up a mess, but how to untangle it is entirely unclear.

The 1974 Act (IEEPA) indeed does not contain any mention of the possibility of unilaterally taking trade measures. However, it is essential to recognize that America, like many other countries, faces issues that are not always resolved lawfully or honestly. For example, some economists have already noted that six out of nine Supreme Court justices were appointed at different times by Republican presidents. So it's quite possible to expect loyalty from them to the current US president.

Trump has already shown how he can and will act, as evidenced by the example with the Fed. If an official does not want to follow Trump's "insistent advice," he is immediately labeled a schemer or a fraud. Therefore, I would not be surprised if, in the event the Supreme Court sides against the presidential administration, Trump tries to fire several sitting justices. Of course, he has just as much authority to do this as he does to dismiss Fed governors—which is to say, none. So, most likely, there would follow all sorts of investigations against disobedient and "unpatriotic" justices, during which many "skeletons in the closet" would be found.

Based on all the above, I believe Trump will not back down from his policies. He will litigate to the very end. If he loses, he will seek alternative methods to exert pressure on the rest of the world. It is also entirely possible that he will terminate or revise already signed trade deals with the EU, UK, Japan, and South Korea, since they would all become illegal. And the dollar could get caught up in a new maelstrom of events. If tariffs are canceled, demand for the US currency will likely rise. But any new action by Trump aimed at destabilizing the world order and altering the trade architecture will instantly trigger another drop in the dollar.

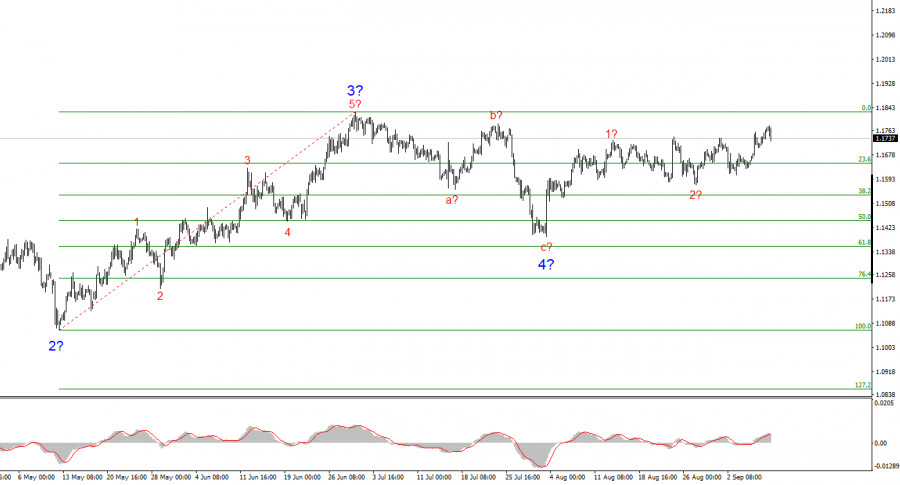

Based on my analysis of EUR/USD, I conclude that the instrument continues to develop an upward trend. The wave markup still depends entirely on the news background related to Trump's decisions and US foreign policy. The trend stretch targets can reach as high as the 1.25 area. Therefore, I continue to consider longs with targets around 1.1875, which corresponds to a 161.8% Fibonacci, and higher. I assume that wave 4 construction is complete; accordingly, now is still a good time to buy.

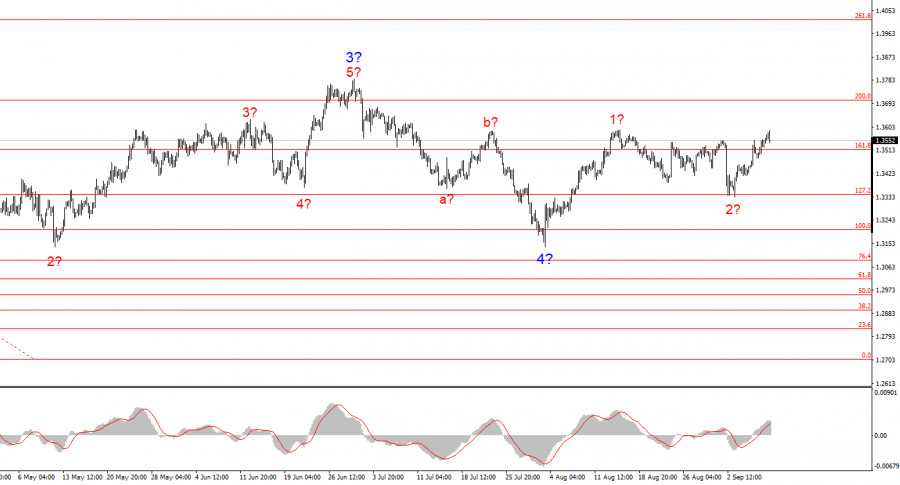

The wave markup for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of a trend. With Trump, markets may experience a huge number of shocks and reversals, which could seriously affect the wave picture, but at the moment, the main scenario remains intact. The current upward segment of the trend now has its target near 1.4017. At this moment, I assume the corrective wave 4 is finished. Wave 2 within 5 may also be complete or close to completion. Accordingly, I recommend buying with a target of 1.4017.

RÁPIDOS ENLACES