The price test at 1.1702 coincided with the moment when the MACD indicator began moving upward from the zero mark, confirming the correct entry point for buying the euro. However, the pair failed to achieve significant growth.

Despite the decline in new home sales in the U.S., the American currency managed to recover all the losses that followed the dovish speech by Federal Reserve Chair Jerome Powell on Friday. Market players had likely expected a stronger statement regarding inflation and keeping interest rates at elevated levels, but Powell instead emphasized the need for cautious actions in light of recent economic developments.

Initially, such caution caused dissatisfaction among investors, who feared that the Fed might begin cutting rates. However, a closer analysis showed that discussions on this topic are still far from translating into actual policy easing.

Today, there are no economic releases from the eurozone, which gives the EUR/USD pair a slight chance for a correction. Still, a strong upward surge is unlikely, so trading within the range seems more probable.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

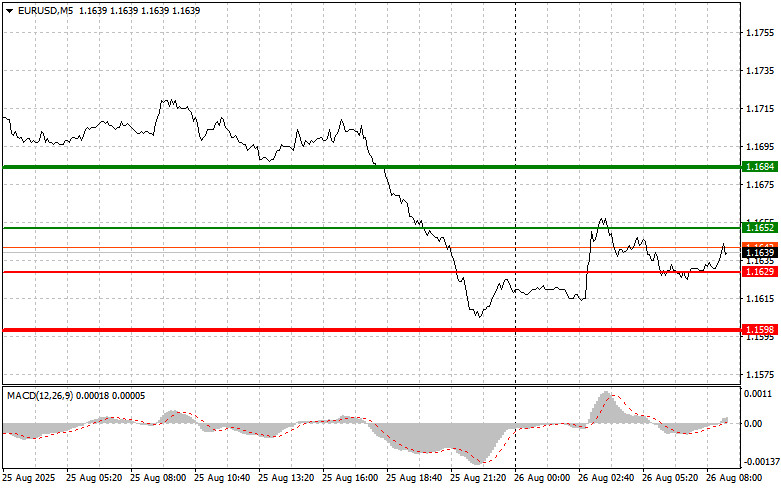

Scenario #1: Today, I plan to buy the euro if the price reaches the area of 1.1652 (green line on the chart) with a target at 1.1684. Around 1.1684, I plan to exit the market and also sell the euro in the opposite direction, counting on a 30–35 point pullback from the entry point. Counting on euro growth is possible only within a correction.

Important! Before buying, make sure the MACD indicator is above the zero line and only starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of 1.1629 at the moment when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth toward 1.1652 and 1.1684 can be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.1629 (red line on the chart). The target will be 1.1598, where I intend to exit sales and immediately buy in the opposite direction (counting on a 20–25 point rebound from the level). Downward pressure on the pair will return today.

Important! Before selling, make sure the MACD indicator is below the zero line and only starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of 1.1652 at the moment when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal downward. A decline toward 1.1629 and 1.1598 can be expected.

RÁPIDOS ENLACES