Trade Review and Tips for the Euro

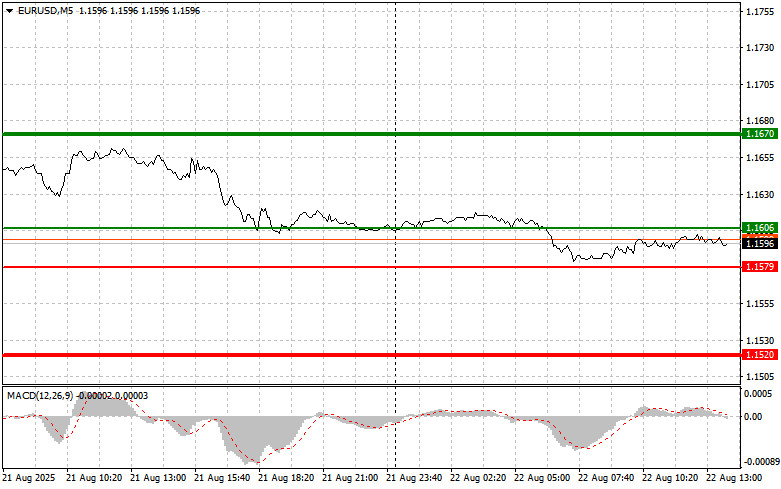

The price test at 1.1597 coincided with the moment when the MACD indicator had just started moving upward from the zero line. This confirmed the correct entry point for buying the euro and resulted in a modest 7-point rise.

Disappointing German GDP data limited the pair's upward potential in the first half of the day. Weak results from the eurozone's leading economy raise concerns about the stability of the entire region. Germany's economic weakness had been forecast, so there was no strong market reaction. On the other hand, these figures point to deeper economic problems that may worsen in the second half of the year.

Now all eyes are on the upcoming speech by Federal Reserve Chair Jerome Powell and his comments on the future path of monetary policy. Market participants and analysts will carefully analyze every statement in an effort to understand the Fed's strategy regarding inflationary pressures, interest rates, and economic dynamics. In the current environment, marked by high inflation and a slowdown in the labor market, the Fed faces a difficult task. On the one hand, it must curb inflation, which could potentially trigger an economic downturn. On the other hand, overly tight monetary policy risks suppressing growth and fueling social tensions. That is why Powell's signals to the market must be clear and well-balanced. He is expected to emphasize the Fed's determination to fight inflation, while highlighting the importance of considering risks to economic development. It is critical for the market to recognize the Fed's readiness to respond quickly to changing conditions and adjust policy accordingly.

As for intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, euro purchases can be considered around 1.1606 (green line on the chart), targeting growth to 1.1670. At 1.1670, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35-point move from the entry. A stronger rally in the euro may follow if Powell adopts a dovish stance. Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro in case of two consecutive tests of the 1.1579 level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and trigger a reversal to the upside. Growth toward the opposite levels of 1.1606 and 1.1670 may then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1579 (red line on the chart). The target will be 1.1520, where I intend to exit and immediately buy in the opposite direction (expecting a 20–25-point rebound from this level). Pressure on the pair will return if the Fed takes a hawkish stance. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1606 level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and trigger a downward reversal. A decline toward the opposite levels of 1.1579 and 1.1520 may then be expected.

Chart Notes:

Important: Beginner Forex traders must be very cautious when deciding on market entries. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you do trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not apply money management and trade with large volumes.

And remember: for successful trading you need a clear plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.

RÁPIDOS ENLACES