Indonésie oznámila plán zvýšit dovoz potravin a komodit z USA až o 19 miliard dolarů. Cílem je snížit obchodní přebytek s Washingtonem a vyhnout se 32% clu, které bylo prozatím odloženo o 90 dní.

Ministr hospodářství Airlangga Hartarto uvedl, že Indonésie plánuje nakoupit více energie, pšenice, sóji a strojního vybavení z USA a zároveň omezit dovoz z jiných zemí.

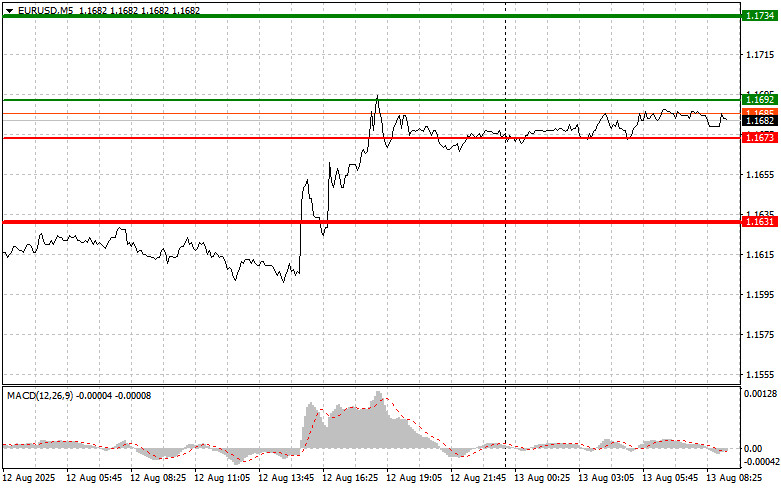

The test of the 1.1620 price level occurred when the MACD indicator had just begun moving upward from the zero mark, confirming the correct entry point for buying the euro and resulting in an increase of more than 40 pips.

The rise took place after news that US inflation had remained unchanged, suggesting a possible slowdown in price growth. This development put pressure on the dollar, which weakened somewhat against the euro. All of this indicates that the Federal Reserve will likely continue to monitor economic indicators closely and will be prepared to take the necessary measures if inflation begins to approach the 2% target consistently.

Today, in the first half of the day, a pause in the euro's upward movement is possible, as no macroeconomic data are scheduled apart from the release of Germany's Consumer Price Index (CPI) and Harmonized Index of Consumer Prices (HICP). The lack of additional economic indicators, apart from the German CPI and HICP data, suggests a potential slowdown in the euro's strengthening during the first half of the day. German inflation data rarely deviates significantly from forecasts, so strong directional moves are unlikely. Investors are expected to take a wait-and-see approach, seeking clearer signals about the state of the German economy and the future monetary policy actions of the European Central Bank.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario No. 1: Today, I plan to buy the euro if the price reaches around 1.1692 (green line on the chart), targeting a rise to the 1.1734 level. At 1.1734, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 pip move from the entry point. Buying the euro is justified within the observed upward trend. Important! Before buying, make sure the MACD indicator is above the zero mark and has just begun to rise from it.

Scenario No. 2: I also plan to buy the euro if there are two consecutive tests of the 1.1673 price level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. A rise toward the opposite levels of 1.1692 and 1.1734 can be expected.

Scenario No. 1: I plan to sell the euro after reaching the 1.1673 level (red line on the chart). The target will be 1.1631, where I plan to exit the market and immediately buy in the opposite direction, aiming for a 20–25 pip move in the opposite direction from the level. Strong pressure on the pair is possible today if weak data are released. Important! Before selling, make sure the MACD indicator is below the zero mark and has just begun to decline from it.

Scenario No. 2: I also plan to sell the euro if there are two consecutive tests of the 1.1692 price level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a downward market reversal. A decline toward the opposite levels of 1.1673 and 1.1631 can be expected.

RÁPIDOS ENLACES