(Reuters) – Společnost BP (NYSE:BP) Plc začne ve středu nakládat první náklad zkapalněného zemního plynu ze závodu Calcasieu Pass společnosti Venture Global v Louisianě, podle údajů LSEG.

Loď British Mentor, kterou BP pronajímá, se chystá zakotvit v přístavu Calcasieu Pass. Jedná se o první náklad, který BP obdrží z exportního zařízení v rámci své smlouvy o dodávkách, více než tři roky poté, co společnost Venture Global začala prodávat LNG z tohoto zařízení na spotovém trhu.

Společnost Galp Energia (ELI:GALP) již dříve ve středu uvedla, že z Calcasieu Pass vyvezla svůj první náklad, což signalizuje začátek platnosti dvacetileté smlouvy o dodávkách podepsané v roce 2018 na 1 milion tun LNG ročně z tohoto závodu.

Podle údajů společnosti LSEG byl náklad společnosti Galp naložen na loď Gaslog (NYSE:GLOG) Wellington.

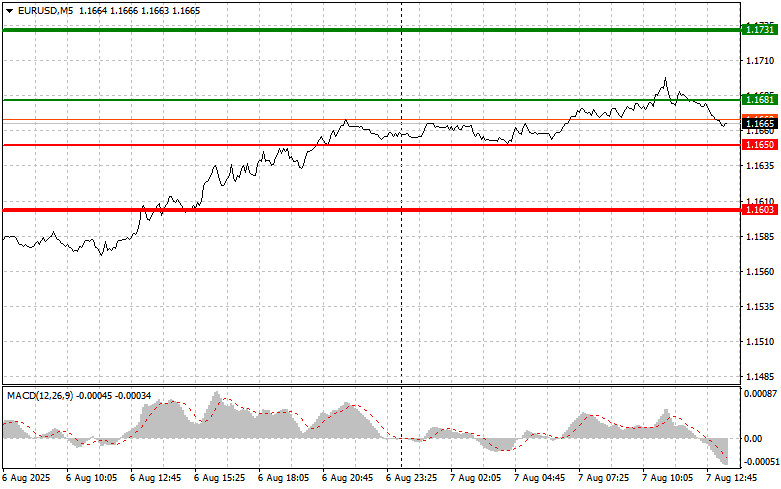

The test of the 1.1685 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For that reason, I did not buy the euro.

In the first half of the day, the euro failed to strengthen and remained under pressure following the release of another disappointing set of German industrial data, signaling persistent issues in the eurozone's leading economy. Nevertheless, the euro showed some resilience, likely due to hopes of future stimulus measures from the European Central Bank.

In the second half of the day, pressure on the EUR/USD pair is expected to increase. The catalyst for this could be strong U.S. initial jobless claims data as well as hawkish rhetoric from FOMC member Raphael Bostic. U.S. consumer credit figures will also be closely monitored by market participants. If jobless claims come in below forecasts, it will indicate strength and stability in the U.S. labor market, potentially prompting the Federal Reserve to act more decisively in monetary policy.

Public statements from Raphael Bostic could also influence EUR/USD movement. If he confirms confidence in continued U.S. economic growth and the need to fight inflation, the dollar will likely gain additional support. Consumer credit figures should not be overlooked either. Growth in consumer borrowing may indicate rising consumer activity, which is a positive sign for the U.S. economy and, therefore, for the dollar.

As for the intraday strategy, I will mainly rely on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buy the euro today when the price reaches 1.1681 (green line on the chart) with a target of 1.1731. At 1.1731, I plan to exit the market and open a sell position in the opposite direction, aiming for a 30–35 point reversal from the entry point. A strong euro rally today is possible only if the Fed adopts a very dovish stance. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1650 level while the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal upward. A rise toward 1.1681 and 1.1731 may then follow.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches 1.1650 (red line on the chart), targeting 1.1603, where I will exit the market and buy in the opposite direction (expecting a 20–25 point reversal). Pressure on the pair will increase if the Fed delivers a hawkish message. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to move downward.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1681 level while MACD is in overbought territory. This would limit the upward potential and trigger a reversal downward. A decline toward 1.1650 and 1.1603 could then follow.

Chart Legend:

Important: Beginner Forex traders should be very cautious when making entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-losses can quickly result in a total loss of your deposit, especially if you don't use proper money management and trade large volumes.

And remember, successful trading requires a clear plan like the one shown above. Making spontaneous decisions based on the current market situation is a losing strategy for an intraday trader.

RÁPIDOS ENLACES