While the Bank of Japan has loosened its grip, market participants are attempting to follow broader market trends in the USD/JPY pair. They came close to testing the nearest line of the price channel, but Friday's U.S. employment data got in the way.

However, the market now appears to have recovered and is ready to attempt testing the price channel line again — this time at a higher level, around 152.25. To achieve this, it is crucial to first consolidate above the 149.38 level, which corresponds to the MACD line on the weekly chart.

If consolidation does not occur, a reversal toward a medium-term decline may take place, with a target at 139.59.

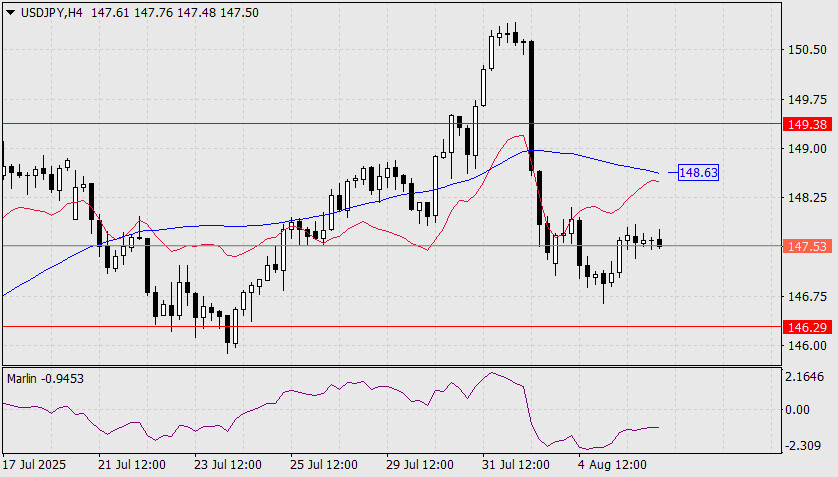

On the four-hour chart, the price is consolidating at the intermediate level of 147.53. With the Marlin oscillator rising, the advantage currently lies with the buyers.

A breakout above the Kijun-sen line would signal the price's readiness for a difficult battle with the 149.38 level.

If the price consolidates below 146.29, it will engage in an equally intense battle with the daily-scale MACD line and the lower boundary of the price channel to break below it. This lower boundary is located at 144.50.

RÁPIDOS ENLACES