Praha – Mezinárodní Letiště Václava Havla v Praze muselo dnes brzo ráno kvůli mlze dočasně odložit všechny přílety a odlety. Okolo 09:30 se má viditelnost v Ruzyni zlepšit, a omezení by poté mohlo skončit, řekla ČTK mluvčí Letiště Praha Denisa Hejtmánková. Samotné letiště zůstává otevřené.

Analysis of Trades and Trading Recommendations for the Euro

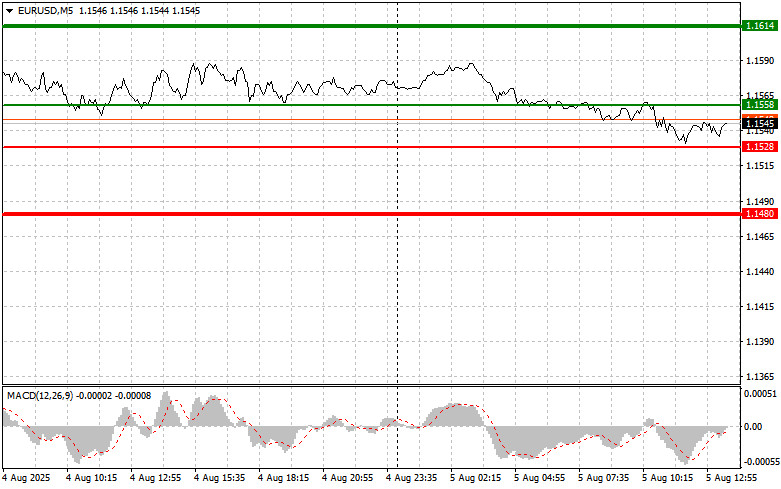

The test of the 1.1543 level occurred when the MACD indicator had just begun moving downward from the zero mark, confirming a valid entry point for selling the euro. However, after a 15-point decline, the pressure on the pair eased.

The downward revision of the Eurozone services PMI for July negatively affected the euro in the first half of the day. Although the index remains above the key 50 level that separates expansion from contraction, its decline versus expectations fuels concerns about the region's economic outlook. The weak PMI reading also dragged down the composite index, which missed economists' forecasts. Going forward, the euro's dynamics will depend on several factors, including future ECB decisions on interest rates, inflation figures, and the overall state of the global economy.

As for the short-term outlook, the second half of the day will see the release of encouraging U.S. data: the ISM Services PMI, the composite PMI, and the trade balance. The ISM Services PMI is a key gauge of the health of the U.S. economy. A reading above forecasts would indicate continued expansion in the services sector—undoubtedly a positive signal. The trade balance is also important. A narrowing trade deficit following Trump's tariffs would point to rising exports and, consequently, increased domestic output. However, it's important to remember that a few favorable reports do not guarantee a sustained economic recovery.

Regarding the intraday strategy, I will primarily focus on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buy the euro today at around 1.1558 (green line on the chart) with a target of 1.1614. I plan to exit the market at 1.1614 and initiate a sell position in the opposite direction, aiming for a 30–35 point move. A strong euro rally today is only likely if the U.S. data is very weak. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1528 level while the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a reversal to the upside. A rise toward 1.1558 and 1.1614 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1528 level (red line on the chart). The target is 1.1480, where I plan to exit and immediately buy in the opposite direction, aiming for a 20–25 point rebound. Selling pressure on the pair will increase if the U.S. data is strong. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1558 level while the MACD indicator is in overbought territory. This would limit the pair's upward potential and trigger a downward reversal. A decline toward 1.1528 and possibly 1.1480 may follow.

Chart Explanation:

Important: Beginner traders in the Forex market should make entry decisions with great caution. Before the release of important fundamental data, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit, especially if you ignore money management principles and trade large volumes.

And remember, successful trading requires a clear trading plan—like the one presented above. Making impulsive trading decisions based on current market conditions is a losing strategy for intraday traders.

RÁPIDOS ENLACES