Akcie společnosti Hertz Global Holdings (OTC:HTZGQ) Inc (NYSE:HTZ) klesly po skončení obchodování o 2,5 % poté, co bylo odhaleno narušení bezpečnosti dat na platformě dodavatele, které mohlo ohrozit osobní údaje některých osob. Obří autopůjčovna potvrdila, že k neoprávněnému přístupu k datům došlo prostřednictvím zranitelnosti nultého dne v systému dodavatele Cleo Communications US, LLC na konci roku 2024.

Narušení, které společnost Hertz zveřejnila 2. dubna 2025 po dokončení analýzy dat, potenciálně odhalilo jména zákazníků, kontaktní údaje, data narození, informace o kreditních kartách a řidičských průkazech, jakož i citlivé údaje týkající se nároků na odškodnění pracovníků. U menší části osob mohla být zasažena také čísla sociálního pojištění, údaje o cestovních pasech a další vládní identifikační čísla.

V reakci na tento incident společnost Hertz přijala opatření k posílení bezpečnosti osobních údajů. Společnost oznámila narušení bezpečnosti orgánům činným v trestním řízení a v současné době informuje příslušné regulační orgány. Aby společnost Hertz zmírnila riziko pro postižené osoby, zajistila si prostřednictvím společnosti Kroll dvouleté bezplatné sledování identity nebo služby sledování temných webů.

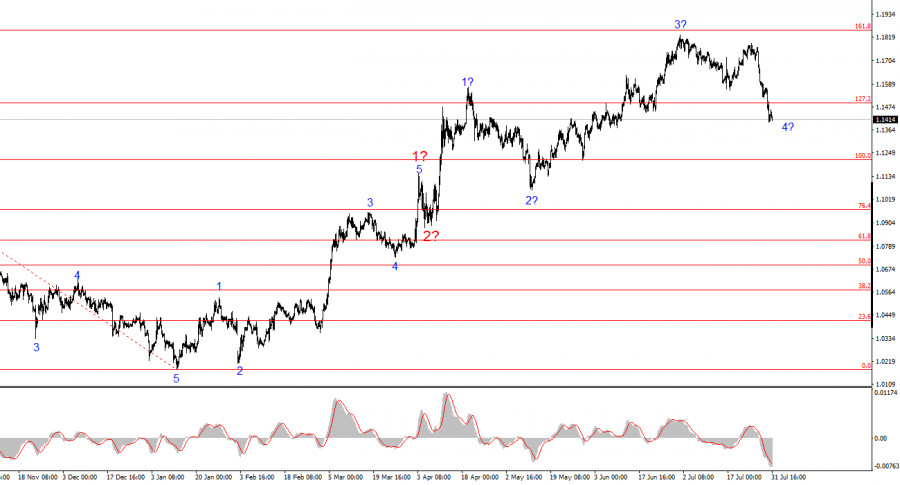

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months. The upward segment of the trend continues to form, while the news backdrop mostly fails to support the dollar. The trade war initiated by Donald Trump was intended to boost budget revenues and eliminate the trade deficit. However, these targets have yet to be achieved—trade deals are being signed with great difficulty, and Trump's "One Big Law" is expected to increase the U.S. national debt by 3 trillion dollars in the coming years. The market has a very low opinion of Trump's first six months in office, and his actions continue to be seen as a threat to American stability and prosperity.

Currently, the pair continues forming wave 4 within wave 3, which may take the shape of a three-wave structure. If this scenario holds, wave 4 may complete soon. However, the news background plays a significant role in shaping corrective wave structures. If the U.S. dollar continues to receive support, the corrective phase could become more extended or transition into an impulsive wave pattern.

On Thursday, the EUR/USD pair moved very little, which was expected, as today is objectively the quietest day of the week. Recall that since Monday, the market has been in turmoil multiple times. First, Donald Trump signed a deal with the European Union that seems to benefit only the United States. Tuesday brought a pause. On Wednesday, the outcome of the Federal Reserve meeting turned out to be much more hawkish than the perpetually dovish market had anticipated. Additionally, U.S. GDP growth reached 3% in the second quarter—well above expectations. Today, as mentioned, is nearly a day off, but another storm is expected tomorrow.

For the past six months, I have regularly noted that the dollar's decline was not entirely justified, as the market ignored or overlooked many key factors—particularly the monetary policies of the ECB, BoE, and FOMC. Therefore, the current strengthening of the U.S. currency aligns with both the news background and the wave structure. For once, the dollar has earned the market's favor, although in my view, this is still just a corrective phase. This week's news flow has not only been strong and important but also almost entirely in favor of the U.S. dollar. It's rare to see all reports and news align in support of a single currency. So I believe the dollar has simply gotten lucky this week.

Just one more day remains. Tomorrow, reports on unemployment and the labor market will be released, along with the important ISM Manufacturing Index for the U.S. In addition, market participants will be analyzing the inflation report from the Eurozone. It's quite possible that tomorrow demand for the U.S. dollar will rise again on the back of strong economic data.

Based on the EUR/USD analysis, I conclude that the pair continues to form an upward trend segment. The wave structure still heavily depends on the news background related to Trump's decisions and U.S. foreign policy. The trend's targets may extend as far as the 1.2500 level. Accordingly, I continue to view buying opportunities with targets near 1.1875 (161.8% Fibonacci) and higher. In the coming days, wave 4 may complete, so this week traders should look for new buying opportunities and closely monitor the news background.

Core Principles of My Analysis:

RÁPIDOS ENLACES