Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

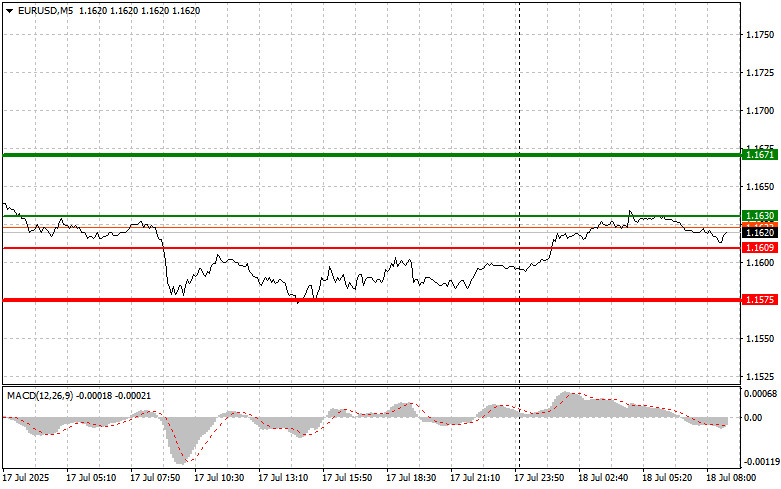

The test of the 1.1575 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For that reason, I did not sell. A second test of 1.1575 while the MACD was in oversold territory allowed for the execution of Buy Scenario #2, which resulted in a 25-pip rise in the pair.

Yesterday's strong U.S. retail sales data for June supported the dollar. The increase, which exceeded analysts' expectations, was viewed by the market as a sign of the U.S. economy's resilience despite persistent inflation. The dollar strengthened following the data release, putting pressure on other currencies, particularly the euro. The EUR/USD pair — traditionally used as a barometer of global economic sentiment — reacted immediately by declining, reflecting ongoing bearish sentiment.

Today's European trading session will start with a focus on economic news from Europe. In the first half of the day, investors will focus on the release of Germany's Producer Price Index (PPI) data. This indicator, which reflects inflation in the manufacturing sector, can significantly influence European Central Bank (ECB) policy decisions. If the PPI exceeds expectations, it could raise concerns about persistent inflationary pressure and prompt the ECB to take a more cautious stance on interest rate cuts.

Simultaneously, a report on the ECB's current account balance will be published. This indicator, which shows the difference between incoming and outgoing payments in the eurozone, is a crucial factor in assessing financial stability. The day will conclude with a speech by Bundesbank President Joachim Nagel. His comments will be particularly significant given his recent support for a more conservative approach to rate cuts. Market participants will carefully analyze his remarks for hints about the ECB's future monetary policy and possible timing for its adjustment. Any signals suggesting a pause in the rate-cutting cycle may support the euro.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: Today, I plan to buy the euro when the price reaches the area of 1.1630 (green line on the chart), targeting a rise toward 1.1670. At the 1.1670 mark, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 pip move from the entry point. Today's euro rise is likely to occur only within a correction.

Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro in case of two consecutive tests of the 1.1609 price while the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger a market reversal to the upside. A rise toward the opposite levels of 1.1630 and 1.1670 can be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.1609 (red line on the chart). The target will be 1.1575, where I plan to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move back from the level). Pressure on the pair could return at any moment today.

Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1630 price while the MACD indicator is in overbought territory. This will limit the pair's upside potential and trigger a market reversal to the downside. A decline toward the opposite levels of 1.1609 and 1.1575 can be expected.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RÁPIDOS ENLACES