Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Earlier, U.S. President Donald Trump imposed 25% tariffs on all Japanese exports to the United States, which will take effect on August 1. This move exacerbates Japan's economic challenges, which, coupled with declining real wages and signs of weakening inflation, will likely force the Bank of Japan to abandon plans to raise interest rates this year.

Japanese Prime Minister Shigeru Ishiba described the decision as extremely unfortunate and emphasized that bilateral negotiations would continue in pursuit of a mutually beneficial agreement. Japan is hoping to arrange a meeting between chief negotiator Ryosei Akazawa and U.S. Treasury Secretary Scott Bessent during his visit to the World Expo on July 19.

Domestic political instability remains an additional negative factor for the yen.

At the same time, concerns over the economic consequences of the U.S. tariffs are fueling investor anxiety, as reflected in declining sentiment across U.S. equity markets. This, in turn, is partly supporting the yen as a safe-haven currency, helping to limit its losses.

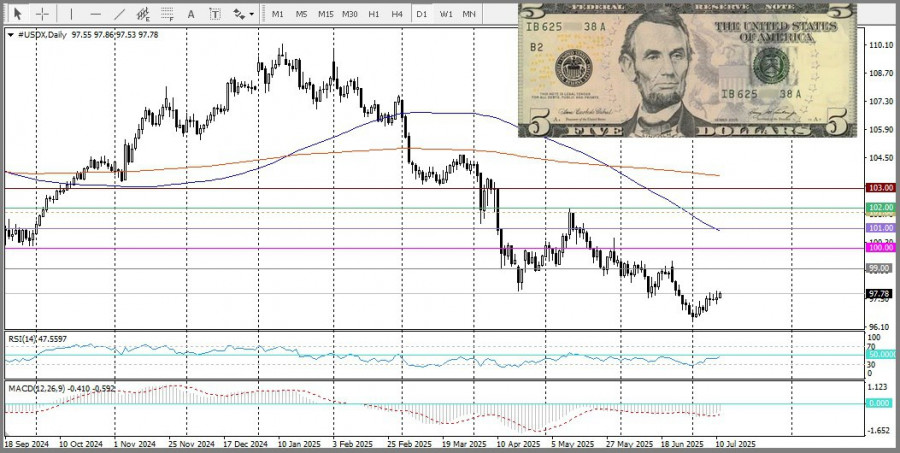

The dollar, by contrast, is gradually strengthening amid reduced expectations for a near-term rate cut by the Federal Reserve.

Fundamentals suggest that the most likely direction for USD/JPY is upward. Therefore, any short-term pullbacks can be seen as opportunities to buy, provided there are no significant news developments.

From a technical perspective, for the second day in a row, buyers are becoming active when the price declines toward the 100-hour simple moving average (SMA). A breakout above the 147.00 level and consolidation above it would provide an additional bullish signal, supported by positive indicators on both the hourly and daily charts. In this case, the price may climb higher and reach the key psychological level of 148.00.

On the other hand, support is likely to hold near the 100-hour SMA. A break below the 146.00 level would open the way for further declines, potentially shifting sentiment in favor of USD/JPY sellers. In this scenario, the drop could continue toward the 145.50 level, with a possible extension to the key psychological level of 145.00.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RÁPIDOS ENLACES