Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Very few macroeconomic reports are scheduled for Tuesday, and none are of significant importance. Essentially, the only one worth mentioning is the German Business Climate Index — but who is genuinely interested in that indicator now? Yesterday, the market outright ignored eight business activity indices from Germany, the EU, the UK, and the U.S., as other news clearly overshadowed them. A similar situation is likely to unfold today.

Among Tuesday's fundamental events, the speeches by European Central Bank President Christine Lagarde and Federal Reserve Chair Jerome Powell stand out. Once again, we do not expect any major statements from Lagarde or Powell since the latest ECB and Fed meetings took place very recently, and no significant macroeconomic data has been released since then that would prompt a shift in their monetary policy stance. Surprises are possible but unlikely.

The most significant market issue remains the trade war, with no signs of resolution in sight. Other important themes include mass unrest in the U.S., Trump's "One Big Beautiful Bill," progress (or lack thereof) in trade deal negotiations with 75 countries, new tariffs, and increases to existing tariffs.

The dollar could have counted on support from the Israel-Iran confrontation, in which the U.S. is now directly involved. However, we believe the dollar has already extracted all possible benefits from this situation.

On the second trading day of the week, both currency pairs may continue their upward movement, as the U.S. dollar is now under pressure from the trade war and the Middle East conflict, in which the U.S. is officially involved. Of course, the dollar won't fall forever, but at present, there is no sign of de-escalation in either conflict.

As a result, the parties may continue exchanging strikes, which could trigger new declines for the dollar — a currency no longer considered a "safe haven" by anyone.

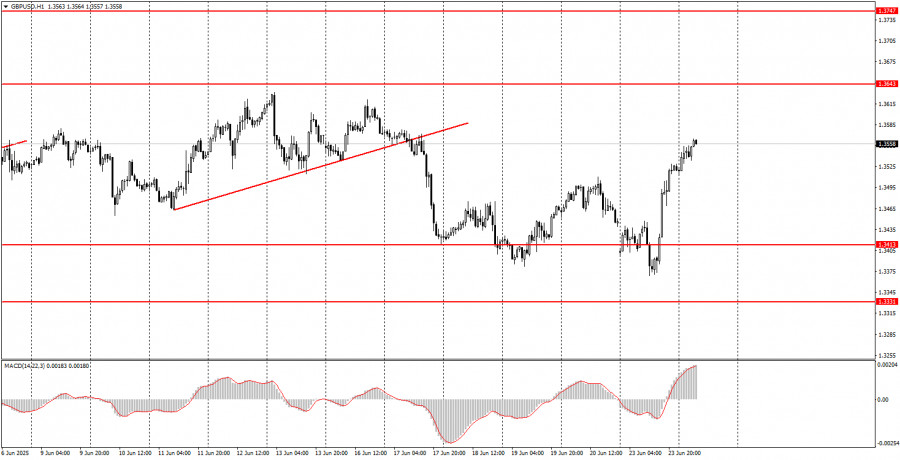

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

RÁPIDOS ENLACES