Společnost Nintendo se ve středu chystá odhalit podrobnosti o svém Switchi 2. Investoři se zajímají o cenu a datum uvedení nástupce domácího přenosného herního zařízení Switch.

Analytici očekávají, že přechod na nové zařízení bude snadný a že společnost z Kjóta nabídne vylepšený hardware a zároveň se bude držet tvaru a funkcí svého předchůdce.

Switch se prodal ve více než 150 milionech kusů, přičemž jeho životní cyklus prodloužily obnovy hardwaru a herní hity ze sérií jako „Super Mario“ a „The Legend of Zelda“.

Analytik společnosti Jefferies Atul Goyal očekává, že se Switch 2 bude prodávat za 399 až 499 dolarů a bude uveden na trh v květnu až červnu.

On Thursday, the EUR/USD pair declined to the 76.4% corrective level at 1.1454, bounced off it, and turned in favor of the euro. It is still too early to conclude that the bearish trend that began this week has ended, but the bears failed to overcome the first significant obstacle in their path. A consolidation below the 1.1454 level would open the way for another bearish attack toward the support zone at 1.1374–1.1380.

The last completed upward wave failed to break the previous high, while the new downward wave broke the previous low. Thus, the trend is currently shifting to bearish. The lack of real progress in U.S.–China and U.S.–EU negotiations makes the bears hesitant to launch further attacks, and the FOMC meeting did not support the U.S. dollar. Therefore, I'm not yet convinced that the bearish trend will gain strong momentum.

The news background on Thursday offered nothing of interest for either the euro or the dollar. The Bank of England meeting took place that day, but it had no impact on the EUR/USD pair. Traders also responded rather sluggishly to the FOMC meeting, though, to be fair, there was little to react to—Powell made no important statements, and there were no changes in monetary policy. As a result, by the end of the week, the bears had lost all motivation. The only notable event this week remains the conflict between Israel and Iran. The two sides continue to exchange missile strikes, and the United States may potentially join the war. However, this is not a certainty. The bears launched two attacks on news of escalating tensions in the Middle East, but on Friday, they lacked any solid basis for a new offensive. They also failed to push the price significantly lower, so their position remains rather weak. The bulls are simply waiting for a more favorable moment.

On the 4-hour chart, the pair returned to the 127.2% corrective level at 1.1495. The downward movement may continue toward the lower boundary of the ascending trend channel, which still suggests the preservation of the bullish trend. A consolidation below the trend channel would open the way for a more significant decline toward the 100.0% Fibonacci level at 1.1213. No divergences are forming on any indicator today.

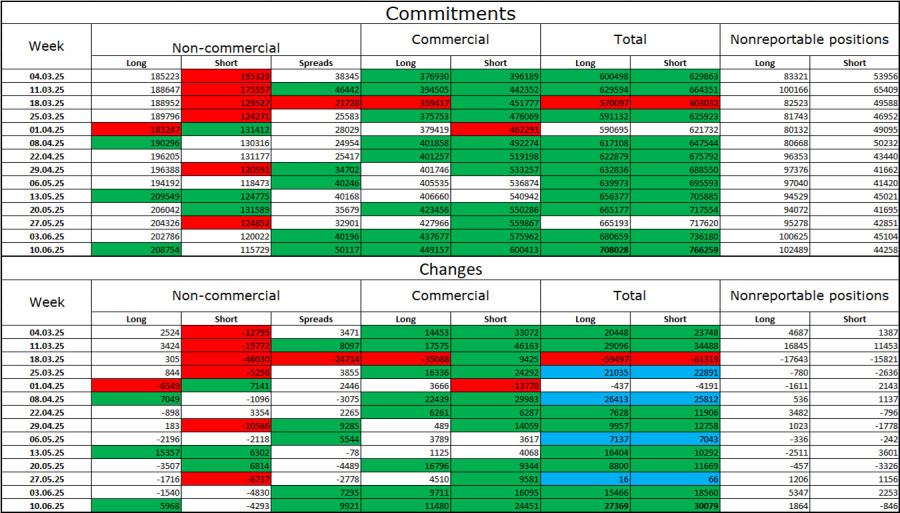

Commitments of Traders (COT) Report:

During the last reporting week, professional traders opened 5,968 Long positions and closed 4,293 Short positions. The sentiment of the "Non-commercial" group remains bullish—mainly due to Donald Trump. The total number of Long positions held by speculators now stands at 208,000, while Short positions total 115,000. The gap between them continues to widen, with few exceptions. This indicates steady demand for the euro and a lack of interest in the dollar. The situation remains unchanged.

For nineteen consecutive weeks, large players have been reducing their Short positions and increasing Longs. Despite the growing policy divergence between the ECB and the Fed, traders see Trump's policies as a more significant factor, as they may lead to a recession in the U.S. economy and other long-term structural problems for America.

Economic calendar for the U.S. and EU:

June 20 contains no noteworthy economic events. Therefore, the news background will have no impact on market sentiment this Friday. However, it is worth noting that the U.S. could strike Iran at any moment.

EUR/USD forecast and trader tips:

Selling the pair was possible after closing below the 1.1574 level on the hourly chart with a target at 1.1454. That target has been achieved. New selling opportunities may arise if the pair closes below 1.1454, with a target at 1.1374–1.1380. I recommended buying on a rebound from 1.1454 with a target at 1.1574. These positions can remain open.

Fibonacci grids are drawn from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

RÁPIDOS ENLACES