-Více než 300 000 Kanaďanů se v neděli v některých částech Ontaria potýkalo s výpadky elektřiny, protože tento region o víkendu zasáhla ledová bouře, uvedl poskytovatel elektřiny Hydro One.

Organizace Environment Canada vydala varování před zimní bouří, která v Ottawě, některých částech Quebecu a Ontaria způsobuje mrznoucí déšť, přičemž v některých regionech se očekává, že riziko sněžení smíšeného s ledem nebo přecházejícího v ledové krupičky bude trvat až do pondělního rána.

„Výpadky jsou z velké části způsobeny větvemi a větvemi stromů, které jsou zatíženy hromadícím se mrznoucím deštěm,“ uvedla společnost Hydro One na svých internetových stránkách s tím, že v centrálním Ontariu hrozí také záplavy.

Podle internetových stránek bylo v neděli odpoledne postiženo více než 350 000 zákazníků, přičemž se očekává, že dodávky elektřiny budou obnoveny 1. dubna.

Poskytovatel veřejných služeb Alectra uvedl, že bez proudu bylo asi 35 000 zákazníků, především ve městě Barrie severně od Toronta. „Kvůli ledu na vedeních se postupuje pomalu, ale byly nasazeny všechny dostupné zdroje,“ uvedla v neděli.

Město Orillia v Ontariu vyhlásilo kvůli bouři stav nouze, protože dlouhotrvající mrznoucí déšť nadále způsobuje rozsáhlé výpadky elektřiny, nebezpečné podmínky na silnicích, popadané stromy a vodovodní vedení a škody na veřejné i soukromé infrastruktuře.

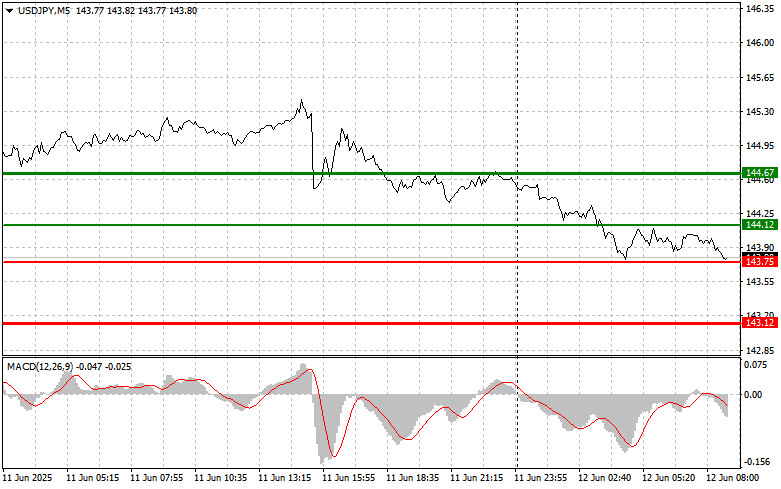

The price test at 145.08 occurred when the MACD indicator had just begun to move downward from the zero line, confirming a valid entry point for selling the dollar. As a result, the pair dropped to around 144.33.

News that U.S. inflation came in lower than economists expected triggered a decline in the U.S. dollar and strengthened the yen. This reaction in the currency market reflects a shift in investor sentiment, with many believing the Federal Reserve may revise its wait-and-see stance toward a more dovish policy. A weaker dollar eases the debt burden for countries with dollar-denominated debt and makes assets denominated in other currencies more attractive. The yen's strengthening is not surprising under these conditions, especially as the Bank of Japan is preparing to continue raising interest rates. Moreover, geopolitical tensions are also playing an important role.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today at the entry point around 144.12 (green line on the chart), with a target at 144.67 (thicker green line). Around 144.67, I intend to exit the long position and open a short position, expecting a 30–35 pip reversal from the level. It's best to return to buying the pair on corrections and significant pullbacks of USD/JPY.

Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy USD/JPY in the event of two consecutive tests of the 143.75 level when the MACD is in oversold territory. This would limit the pair's downside potential and lead to an upward market reversal. In this case, expect a rise toward the opposite levels of 144.12 and 144.67.

Scenario #1: I plan to sell USD/JPY only after a break below 143.75 (red line on the chart), which could lead to a sharp drop in the pair. The key target for sellers will be 143.12, where I will exit the short position and open a long position in the opposite direction (anticipating a 20–25 pip pullback from that level). Selling pressure may return quickly today.

Important! Before selling, make sure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell USD/JPY in the event of two consecutive tests of the 144.12 level when the MACD is in overbought territory. This will limit the pair's upside potential and result in a downward reversal. A decline toward the opposite levels of 143.75 and 143.12 is then expected.

RÁPIDOS ENLACES