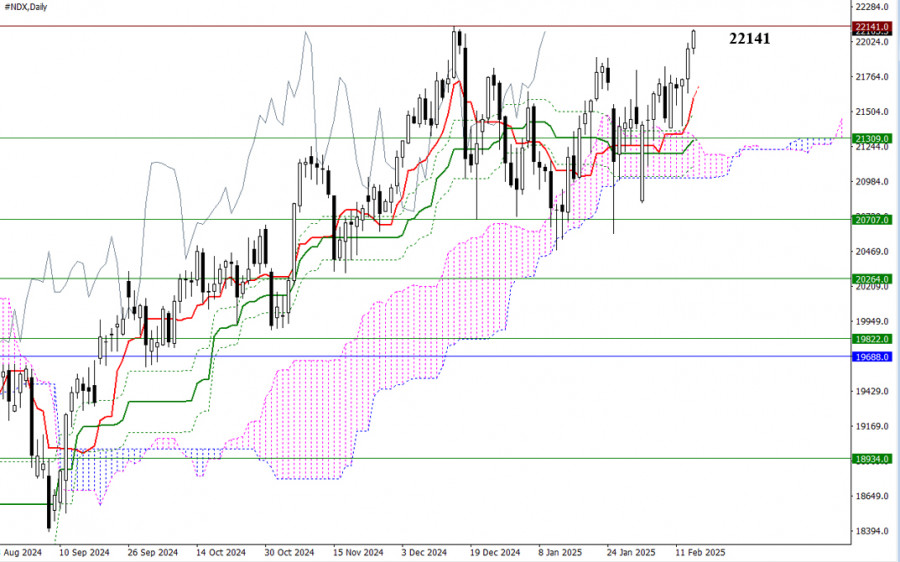

The past trading week has shown a distinct bullish trend. Buyers are focused on completing the downward correction and restoring the uptrend, as they have nearly reached the 2024 high of 22,141. If this positive sentiment continues, the index may move toward new highs, with key psychological levels at 22,500 and 23,000 gaining attention. A successful test and breakthrough of these levels could lead to the establishment of new all-time highs. Additionally, the weekly short-term trend at 21,309 has acted as a crucial point of attraction, helping to maintain consolidation in recent months.

On the daily timeframe, it is evident that despite several attempts by bears to gain control through significant downward gaps, the market spent the past week trying to exit the correction and consolidation phase in order to restore the uptrend. The final objective is to break above the recent high of 22,141 and consolidate above this level. If buyers fail to accomplish this, the market may retreat to the range of 21,704 to 21,014, where all Ichimoku daily levels are clustered and supported by the weekly short-term trend at 21,309. In such a scenario, sellers could push further down toward additional weekly support levels at 20,707 to 20,264 and beyond.

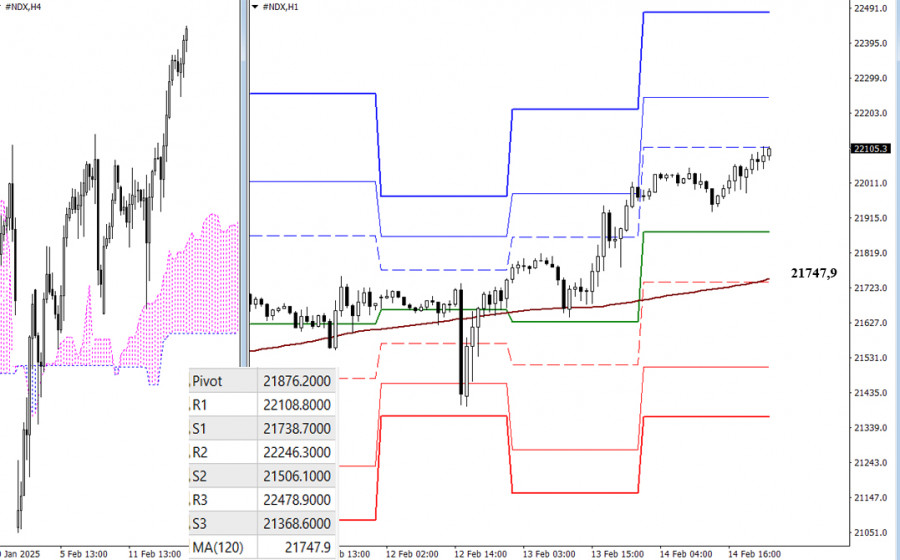

On lower timeframes, buyers currently hold the advantage. Classic pivot resistance levels serve as reference points for continued upward movement. However, a break and reversal of the weekly long-term trend at 21,747.9 would shift the balance in favor of sellers. If this occurs, the pivot support levels will become crucial targets for intraday declines. Updated pivot levels for trading decisions will be available at the market open.

***

RÁPIDOS ENLACES