Agentura Fitch Ratings snížila dlouhodobý rating emitenta (IDR) společnosti Gray Media, Inc. z „BB-“ na „B-“ s odvoláním na vysokou zadluženost a snížené vyhlídky na snížení zadluženosti v roce 2025, tedy v nepolitickém roce. Rating nadřízeného zajištěného dluhu společnosti Gray byl rovněž snížen na „B+“ z „BB+“ a rating nadřízené nezajištěné emise byl snížen na „ CCC (WA:CCCP)“/„RR6“ z „BB-“/„RR4“.

Snížení ratingu odráží vysokou zadluženost společnosti, která byla v posledních čtyřech letech způsobena erozí marží. To výrazně snížilo její schopnost snižovat zadlužení prostřednictvím tvorby volných peněžních toků (FCF), zejména vzhledem k absenci významných globálních mediálních událostí do roku 2026. Agentura Fitch rovněž zohlednila nedávné úsilí společnosti Gray o snížení zadlužení a realizaci iniciativ na úsporu nákladů s cílem stabilizovat marže při zachování uspokojivé likviditní pozice. Negativní výhled je způsoben očekávanou vysokou zadlužeností do roku 2026 a omezeným časovým rámcem pro refinancování nadcházejících splatností počínaje rokem 2027.

Od akvizice společnosti Raycom Media, Inc. v roce 2019 a později společnosti Quincy Media, Inc. a lokálních mediálních aktiv společnosti Meredith (NYSE:MDP) Corporation v roce 2021 se společnosti Gray nahromadil významný dluh související s akvizicemi. To vytváří tlak na kapitálovou strukturu společnosti, přičemž při uzavření akvizice Meredith dosáhla zadluženost L8QA EBITDA přibližně 7,0x. Společnost se zaměřila na rychlé snížení zadluženosti prostřednictvím tvorby FCF.

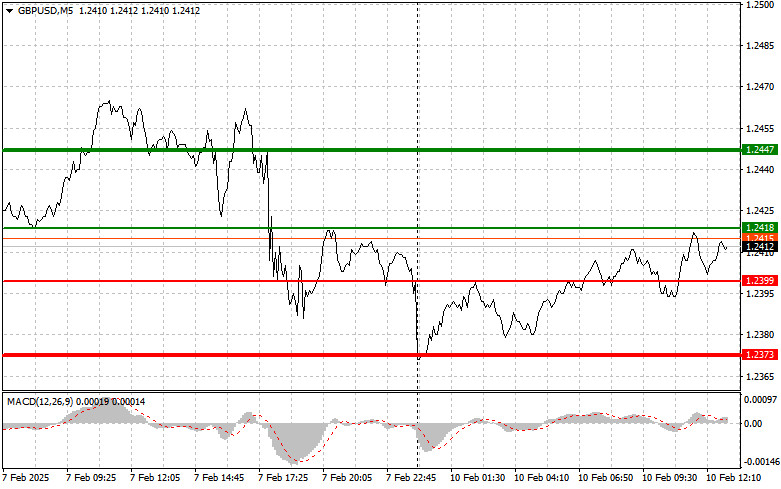

The test of the 1.2394 level occurred when the MACD indicator had already moved significantly below the zero mark, which, combined with the lack of UK economic data, limited the pair's downward potential. For this reason, I did not sell the pound.

The pound failed to break above 1.2418, mainly due to the absence of key fundamental data and uncertainty surrounding new U.S. trade tariffs introduced by Donald Trump. Investors have adopted a wait-and-see approach, fearing an escalation of the trade war and its potential impact on the UK economy—especially given the uncertainty surrounding the Bank of England's next steps amid rising inflation.

The pound's future movement will largely depend on upcoming BoE statements and macroeconomic data, which will provide a clearer outlook on the state of the UK economy and potential monetary policy directions.

In the second half of the day, there are no economic reports from the U.S., which means limited volatility and a lack of strong directional movements in the forex market.

For today's intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Buy Signal for GBP/USD

Scenario #1: Buy the pound when the price reaches 1.2418 (green line on the chart), targeting a rise to 1.2447. At 1.2447, I will exit long positions and sell the pound in the opposite direction, expecting a 30-35 point pullback. Bullish momentum is expected only as part of a correction.Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I will also consider buying the pound if there are two consecutive tests of the 1.2399 level, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. The expected targets are 1.2418 and 1.2447.

Sell Signal for GBP/USD

Scenario #1: Sell the pound after the price drops below 1.2399 (red line on the chart), leading to a quick decline. The key target for sellers will be 1.2373, where I plan to exit short positions and enter long trades on a rebound (expecting a 20-25 point move in the opposite direction). Bearish momentum will strengthen if the daily low is broken.Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I will also consider selling the pound if there are two consecutive tests of 1.2418, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. The expected targets are 1.2399 and 1.2373.

What's on the chart:

Important. Novice Forex traders need to make their entry decisions very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid falling into sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can lose your entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

And remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Spontaneous trading decision-making based on the current market situation is an inherently losing strategy for an intraday trader.

RÁPIDOS ENLACES