The US dollar has finally broken free from the market's optimism regarding the Federal Reserve's rate cut cycle. Over the past two weeks, it has become clear that rate cuts will begin when inflation falls to at least 2.5% y/y. Since the latest inflation report accelerated to 3.5%, I do not expect rate cuts in America in the near future.

The market is still optimistic about the Fed's rates, but now it's much more subdued. According to the CME FedWatch tool, the market expects the first rate cut in July. In my opinion, this forecast has nothing to do with reality. I remind you that many major banks and holdings have already lowered their forecasts to two rounds of cuts this year. Some analysts believe that the first rate cut could happen in December or even in 2025. Therefore, in my opinion, the dollar is on track to surge.

You could say that all of the most important events in April are already behind us. The next FOMC meeting will take place on May 1, but monetary policy is expected to remain unchanged. On the contrary, Fed Chair Jerome Powell and even the entire FOMC committee may show a tougher stance. Perhaps we might even hear a phrase about raising the key rate if the current trajectory of inflation persists. However, expecting words about monetary easing is like expecting snow in summer. All of this will be favorable for the dollar.

The US will mostly release secondary reports in the upcoming week. We'll learn about retail sales, building permits, new home sales, and initial jobless claims. I will only focus on the retail sales data. I consider it the strongest among the ones mentioned above. However, overall, the news reflecting the prospects of Fed rates and inflation in the US is much more important than retail sales or jobless claims. I believe that if the market has already started buying the US currency, then all of the aforementioned reports won't derail it from its course.

There will also be very few significant events in the European Union and the United Kingdom, so I don't expect the reports to have a strong impact on market sentiment. Both instruments can calmly continue their downward movement, which still has a strong potential.

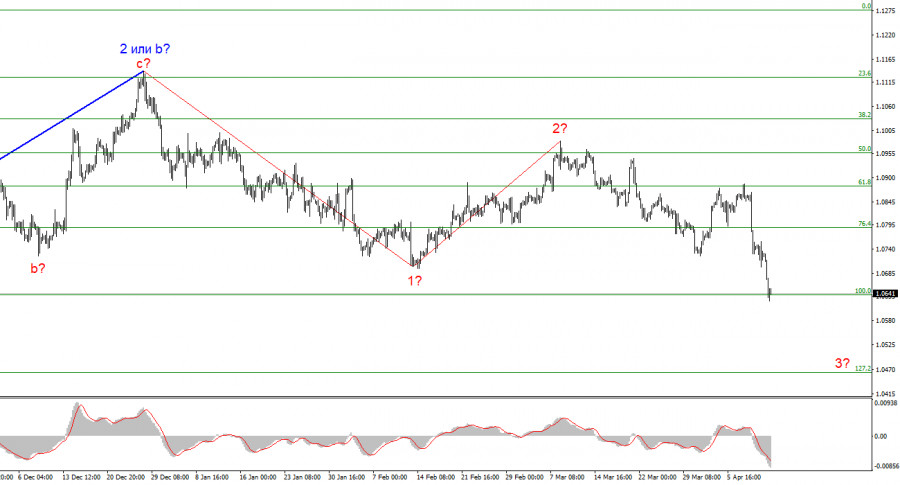

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

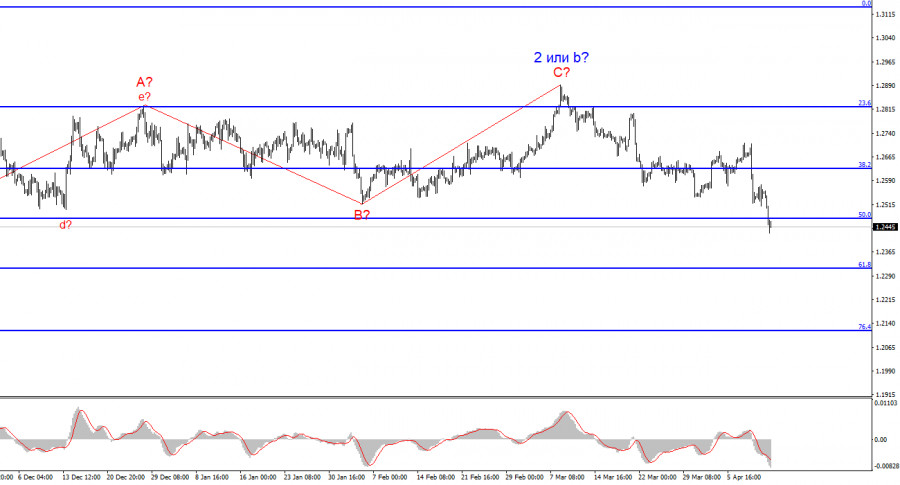

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

RÁPIDOS ENLACES