Francouzský mediální konglomerát Vivendi (EPA:VIV) v pondělí zaznamenal více než 35% nárůst svých akcií po očekávaném rozdělení tří klíčových dceřiných společností: Canal+, Havas a Louis Hachette Group. Cílem restrukturalizace, kterou schválili akcionáři 9. prosince, je změnit profil společnosti a zároveň umožnit odštěpeným subjektům, aby si vytyčily samostatnou cestu na hlavních evropských finančních trzích. V důsledku toho se akcie Vivendi začaly znovu obchodovat na burze Euronext (EPA:ENX) v Paříži jako zjednodušená společnost, bez jejích tří dceřiných společností. Na londýnské burze cenných papírů (LON:LSEG) bude debutovat společnost Canal+, jejíž hodnota se odhaduje na 6 miliard eur, což je největší vstup na londýnský trh za poslední dva roky a posílení důvěry pro Londýn po brexitu. Havas, celosvětově známá reklamní společnost, bude debutovat na burze Euronext Amsterdam, zatímco vydavatelská část Vivendi, Louis Hachette Group, se bude obchodovat na burze Euronext Growth Paris. Společnost Lagardère, jejímž většinovým vlastníkem je Louis Hachette, bude i nadále kótována na burze Euronext Paris – tím bude zajištěno, že si skupina zachová silné zastoupení ve francouzském hlavním městě.

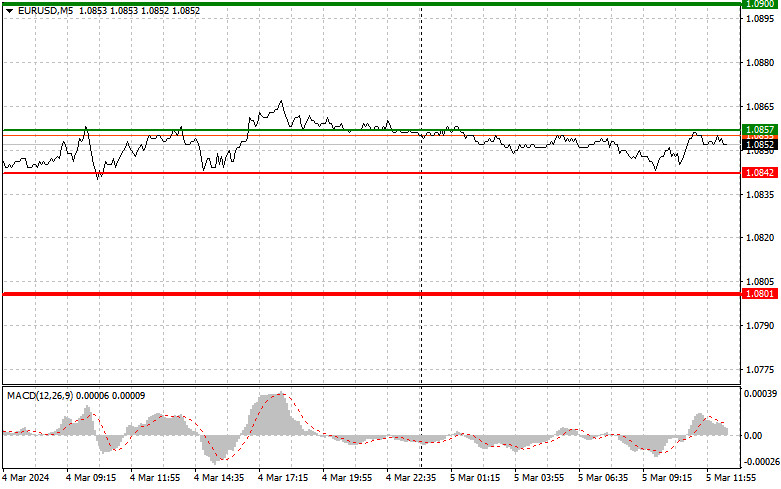

Analysis of transactions and trading tips on EUR/USD

No price tests occurred in the morning due to low market volatility. This happened despite fairly good activity data in the service sector of eurozone countries. In the afternoon, everything will depend on the ISM's report on the business activity index in the service sector and the change in the volume of manufacturing orders. An increase in these indicators could lead to a decline in EUR/USD, as well as a good spike in volatility. If the results match the forecasts, the market will show little activity, which will keep the pair within the channel. The speech of FOMC member Michael S. Barr could also influence the market's direction.

For long positions:

Buy when euro hits 1.0857 (green line on the chart) and take profit at the price of 1.0900. Growth will occur only after very weak data from the US.

When buying, ensure that the MACD line lies above zero or rises from it. Euro can also be bought after two consecutive price tests of 1.0842, but the MACD line should be in the oversold area, as only by that will the market reverse to 1.0857 and 1.0900.

For short positions:

Sell when euro reaches 1.0842 (red line on the chart) and take profit at the price of 1.0801 Pressure will return in the case of an unsuccessful consolidation around the daily high and strong data from the US.

When selling, make sure that the MACD line lies below zero or drops down from it. Euro can also be sold after two consecutive price tests of 1.0857, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0842 and 1.0801.

What's on the chart:

Thin green line - entry price at which you can buy EUR/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell EUR/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

RÁPIDOS ENLACES