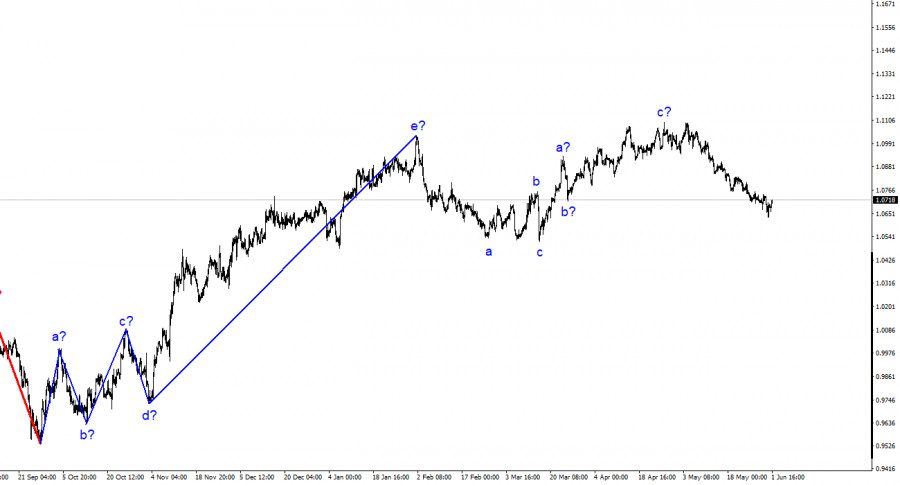

The wave analysis of the 4-hour chart for the euro/dollar pair continues to be non-standard but understandable. The quotes continue to move away from the previously reached highs, so the three-wave upward structure can be considered complete. The entire ascending trend segment may still theoretically form a more complex structure, but at the moment, I expect a downward trend segment, which is likely also to be a three-wave structure. Recently, I have consistently mentioned that I expect the pair near the 5th figure, from where the upward three-wave pattern started.

The top point of the last trend segment was only a few tens of points above the highest point of the previous upward segment. Since December last year, the pair's movement can be considered horizontal, which will continue. If this assumption is correct, then the formation of an ascending wave (b) will begin soon (or may have already started), and the overall decline of the pair will continue after its completion.

Inflation falls faster than expected by the ECB

The euro/dollar exchange rate increased by 35 basis points on Thursday, which is not significant. Most of the recent increase occurred on Wednesday evening. Overall, it moved away from the recent lows by 90 points, which is also not too much. However, the attempt to break through the 23.6% Fibonacci level was unsuccessful, suggesting that the market is ready to build an upward wave, which aligns with the current wave analysis. Wave (b) may not be strong.

The most interesting events on Thursday were undoubtedly the speech of ECB President Christine Lagarde and the inflation report in the EU. Yesterday, I mentioned that the consumer price index might decrease more than market expectations, as similar indicators in other EU countries have decreased more. If inflation in each country is falling faster than forecasted, it is logical to assume that European inflation would also slow down significantly. It dropped from 7% to 6.1% y/y, and the core inflation decreased from 5.6% to 5.3% y/y. This is the first small victory for the ECB, as the core inflation had only lost 0.1% in the previous month but has now dropped by 0.3%.

Regarding Christine Lagarde, she once again confirmed the ECB's commitment to price stability in the eurozone. She stated that the tightening of monetary policy needs to be maintained until confidence in inflation returns to the target level. Lagarde emphasized the word "timely," indicating the ECB's unwillingness to wait for inflation to reach 2% in a few years. At the same time, Lagarde stated that inflation would remain high for a long time, hinting that the ECB's possibilities are not limitless. "At this time, we are not satisfied with the prospects of inflation," Lagarde concluded.

Based on the analysis, the upward trend segment is complete. Therefore, I recommend selling, as the pair has significant room for decline. I still consider the targets around 1.0500–1.0600 quite realistic, and I advise selling the pair with these targets in mind. A corrective wave may start (or has already started) from the level of 1.0678, so I would suggest new sales if there is a successful attempt to break this level.

On a larger wave scale, the wave labeling of the upward trend segment took on an extended form, but it is likely completed. We have seen five upward waves, which most likely form the structure of a-b-c-d-e. The formation of the downward trend segment may still need to be completed, and it can take any form in terms of structure and length.

RÁPIDOS ENLACES