The US dollar is holding below the maximum level in 2.5 weeks on Wednesday. Support for the US currency on Wednesday afternoon is provided by investors' expectations of an increase in the Federal Reserve's interest rate. Some analysts are waiting for specifics on this issue from the central bank today.

The US central bank will announce its decision on monetary policy today, then Fed Chairman Jerome Powell's press conference will begin.

If the Federal Reserve still does not voice its own assumptions about a more aggressive tightening of monetary policy, then the dollar may weaken.

Recall that inflation in the United States has almost reached the highest level in the last 40 years. At the same time, the unemployment rate fell to 3.9%.

Since the beginning of this week, the markets have been in a state of both rise and fall. A kind of roller coaster was created by the hawkish position of the Fed and the obvious slowdown in growth. This combination worried investors, as a result of which the shares of large technology companies were sold off, and more reliable assets, which is the dollar, were in demand.

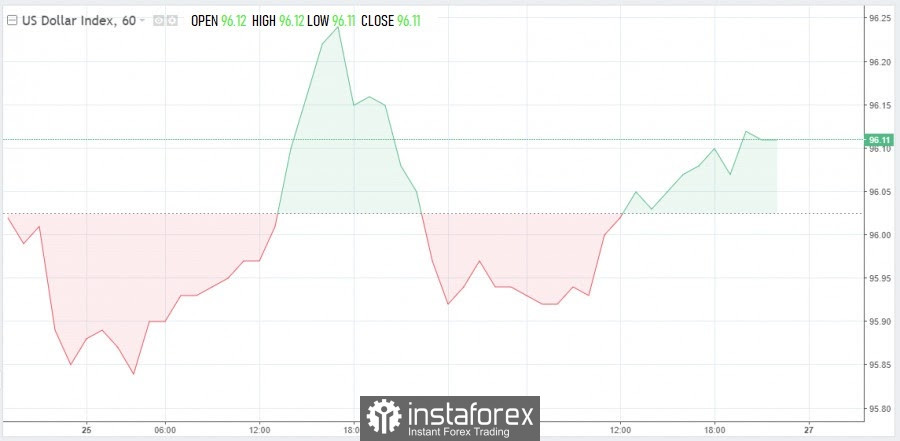

As a result, the dollar on Wednesday against a basket of six major currencies reached its maximum level on January 7 - the 96.30 mark. Later, a decline below this level followed. Wednesday's trading showed a restrained mood of the participants, the greenback at the time of preparation of this material was at 96.11, futures for American stocks at the same time rose on the charts by more than 1%.

USD Index

Tensions between the United States and Russia over Ukraine remain in the foreground. The beginning of this week was stirred up by the statements of the administration of US President Joe Biden about the expansion of the military presence in Eastern Europe due to the possible invasion of Russia on the territory of Ukraine.

According to The New York Times, citing sources in the US administration, the US president does not rule out the possibility of deploying several thousand American troops, as well as ships and aircraft in the Baltic states and Eastern Europe. By the way, Biden admitted the possibility of such a development of events in December, noting at the same time that this could happen only in the event of an invasion of Russian troops on the territory of Ukraine.

On January 22, at a meeting at the country residence of the US president, Camp David Biden was presented with several options from representatives of the Pentagon. One of which involves sending military personnel totaling 1-5,000 to the territory of Eastern Europe. If this plan is implemented, the number of NATO military personnel in Eastern Europe will increase tenfold. According to sources of the popular news outlet, the US president will make a final decision on this issue this week.

At the same time, it should be noted that none of the options proposed by the Pentagon for the development of events provides for additional American troops on the territory of Ukraine itself.

Meanwhile, the Russian Black Sea Fleet has already begun large-scale exercises. More than 20 warships as part of ship groups left the locations of Sevastopol and Novorossiysk, then made the transition to the designated areas in the Black Sea.

RÁPIDOS ENLACES