Sezóna zveřejňování výsledků hospodaření pokračuje a my vám přinášíme přehled společností, které by měly zveřejnit své výsledky v příštím obchodním dni, abyste se mohli připravit na vývoj na trzích. V čele jsou Home Depot (NYSE:HD), Viking Holdings (VIK), Palo Alto Networks (NASDAQ:PANW), Keysight Technologies (NYSE:KEYS) a Vodafone Group (LON:VOD). Tyto zprávy poskytnou cenné informace o různých odvětvích, od maloobchodu a technologií po telekomunikace.

In recent months, the British pound has been under pressure amid debate over the UK budget for the next financial year. Personally, I do not understand the panic in the markets, and I even allow for the possibility that the pound's decline was not due to uncertainty about the budget and taxes. However, Chancellor Rachel Reeves has repeatedly caused market participants to panic and sell the British currency with her statements about taxes and the budget. Thus, a logical pattern emerges without difficulty.

To begin this extensive topic, it is essential to note that the Labour Party promised British voters during the election campaign not to raise taxes. On Wednesday, it became known that the promise was not to "not raise taxes overall," but rather "not to raise income tax only." We will start our review with this particular tax.

All income tax rates in the 2026 budget remained unchanged. The tax-free allowance is £12,570; the basic rate applies to income up to £50,270; the higher rate applies to income up to £125,140; and the additional rate applies to income over £125,140. It seems that what was promised has been delivered. But it's not that simple. I think it's no secret that British inflation is currently much closer to 4% than to the Bank of England's target of 2%. Therefore, even if we use a 2% annual price growth in calculations, prices are still rising. Wages are also increasing, often at much higher rates. The latest wage growth report showed a 4.6% increase.

Accordingly, logically, the thresholds for entering different tax brackets should be updated annually. However, this is precisely the situation in which the government benefits greatly from doing nothing and pretending that such steps are unnecessary. In practice, annual incomes for British households are rising, meaning they transition from lower to higher tax brackets and end up paying more. This is how more taxes can be collected without raising the tax rates.

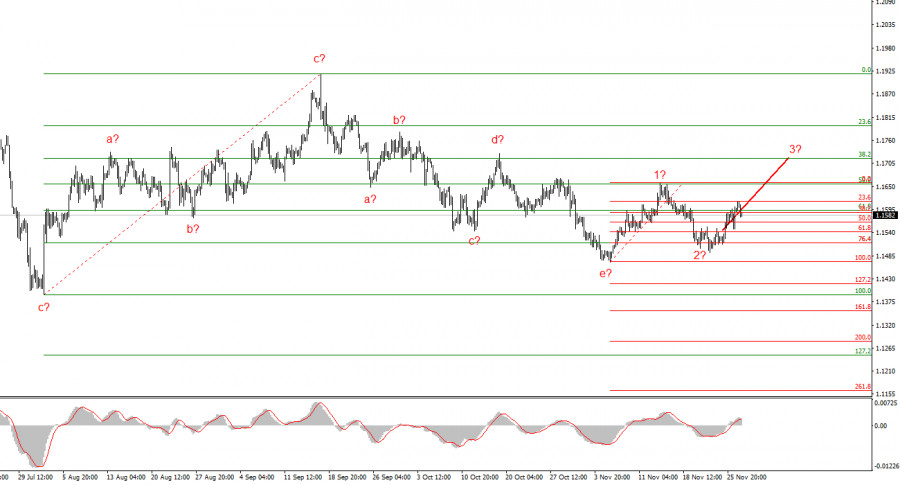

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors in the future decline of the U.S. currency. The targets for the current segment of the trend may extend to the 25th figure. Currently, the formation of the upward wave set may continue. I expect that from the current positions, the third wave of this set will continue, which can be either "c" or "3." At this moment, I remain in long positions with targets around the 1.1740 mark.

The wave structure of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in "4" appears quite complete. If this is indeed the case, I expect the main trend segment to resume its formation with initial targets around the 38 and 40 figures. In the short term, one can expect the formation of wave "3" or "c" with targets around 1.3280 and 1.3360, corresponding to 76.4% and 61.8% on the Fibonacci scale.

LINKS RÁPIDOS