On Wednesday evening, the FOMC minutes were released in the U.S. To be honest, I do not pay much attention to these minutes, as they rarely prompt market participants to react. It should be understood that they are published with a three-week delay, and many of the points raised by the Federal Reserve officials at that time are no longer relevant. It is no secret that the FOMC's position changes over time, influenced by economic data. While there has been little data from the U.S. in the last three weeks, some information has emerged. We have already been briefed on the positions of almost all officials through their own speeches. Thus, the FOMC minutes did not generate much interest for me personally.

The only conclusion I can draw from reviewing this document is that the central bank is uncertain. There is doubt regarding the appropriateness of a third consecutive round of monetary policy easing amid rising inflation. How does the equation look now that the Fed is trying to solve at each meeting? An equation with two variables: the labor market and inflation. If inflation is rising, rates cannot be cut, even if the labor market is "cooling." If inflation is rising moderately, easing is permissible if the labor market is "cooling." If the labor market is not "cooling," it is inappropriate to lower rates because inflation is increasing.

The FOMC minutes showed that in October, many Fed officials were uncertain about their decision, specifically whether to lower rates in December. Although this information may not have been immediately known to the market after the meeting, it became apparent in recent weeks as most FOMC officials' rhetoric leaned "dovish."

It is worth noting that the Fed's stance cannot currently be considered "hawkish," as the U.S. central bank does not plan to raise interest rates anytime soon. Therefore, its stance remains "neutral" for the December meeting and continues to do so after the release of today's Non-Farm Payrolls and unemployment data. The FOMC minutes became outdated three weeks ago, and the labor market data is three months old. We will have to wait for the November data, which will be the basis for the final decision.

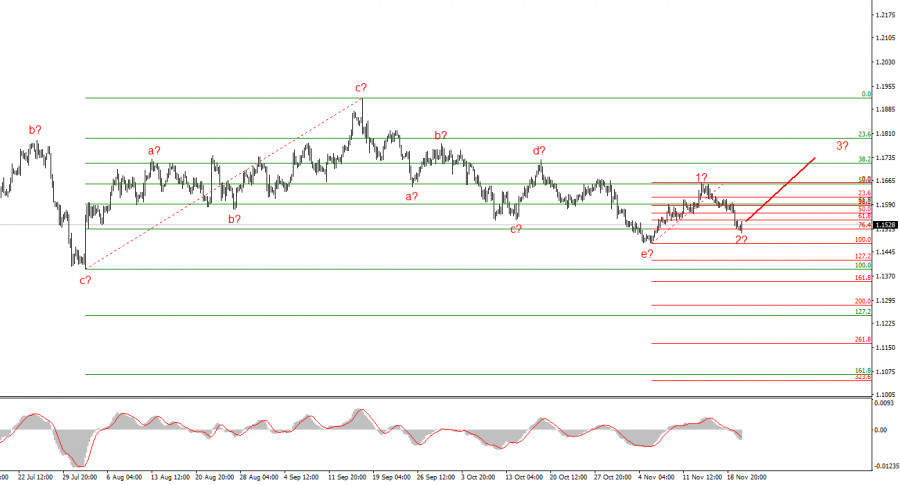

Based on the analysis conducted for EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The market has paused in recent months, but Donald Trump's policy and the Fed remain significant factors influencing the U.S. dollar's future decline. The targets for the current section of the trend could reach the 25-figure mark. A third wave of this set may start forming from current positions, which could be either an impulsive or corrective wave. In the coming days, I anticipate buying opportunities with targets around 1.1740, and an upward reversal of the MACD indicator will confirm this signal.

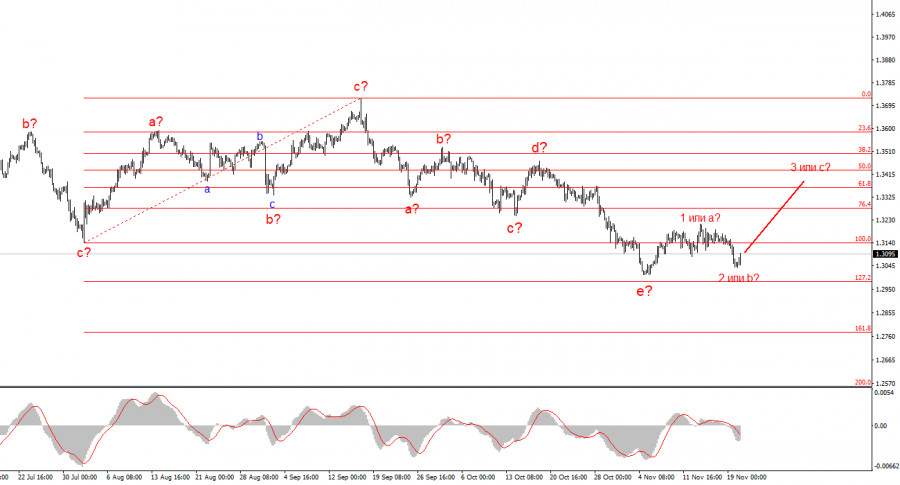

The wave picture for GBP/USD has changed. We continue to deal with a bullish, impulsive section of the trend, but its internal wave structure has become complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in wave 4 looks quite complete. If this is indeed the case, I expect the main trend section to resume its formation with initial targets around the 38 and 40 figures. In the short term, we can expect wave 3 or c to form, with targets around 1.3280 and 1.3360.

LINKS RÁPIDOS