As I mentioned, most Federal Reserve officials support keeping interest rates unchanged three weeks before the next meeting (the last one of the year). What exactly did the officials communicate?

Mary Daly and Neel Kashkari stated that inflation has been elevated and persistent, drifting away from the Fed's target of 2%, hence monetary policy should remain sufficiently "restrictive" to continue curbing price growth. Both officials noted that the FOMC has already lowered rates twice in the second half of 2025, hinting that it will provide "first aid" to the labor market. They also pointed out that the economy is currently stable amid Donald Trump's new trade policy, so further easing is not required at this time.

Daly also noted that it is still too early to discuss the central bank's future decision, as there are more than three weeks left until the year's last meeting. Economic information will soon start coming in, helping officials make the right decision on December 10.

Beth Hammack believes that in December, the Fed should pay more attention to rising inflation, especially if the next report again indicates acceleration. A new increase in the consumer price index would suggest that the Fed is moving away from its 2% target, as any subsequent easing of monetary policy would lead to even higher inflation.

Alberto Musalem stated that inflation in America is too high and that the FOMC should therefore act cautiously going forward. Musalem feels that if interest rates are lowered too much, inflation could spiral out of control for the central bank.

Susan Collins said she does not see a noticeable deterioration in the labor market; therefore, a new round of policy easing is not necessary. She also noted that a new rate cut would be appropriate only when new evidence of the "cooling" of the labor market emerges.

Based on all the comments from FOMC officials, it can be concluded that without new negative data from the Nonfarm Payrolls report, the next round of easing will take a long time to arrive. I do not believe that such a position from the Fed will provide strong support to the dollar, as the central bank is maintaining rates unchanged rather than increasing them. Therefore, I remain inclined to expect an increase in the EUR/USD and GBP/USD instruments.

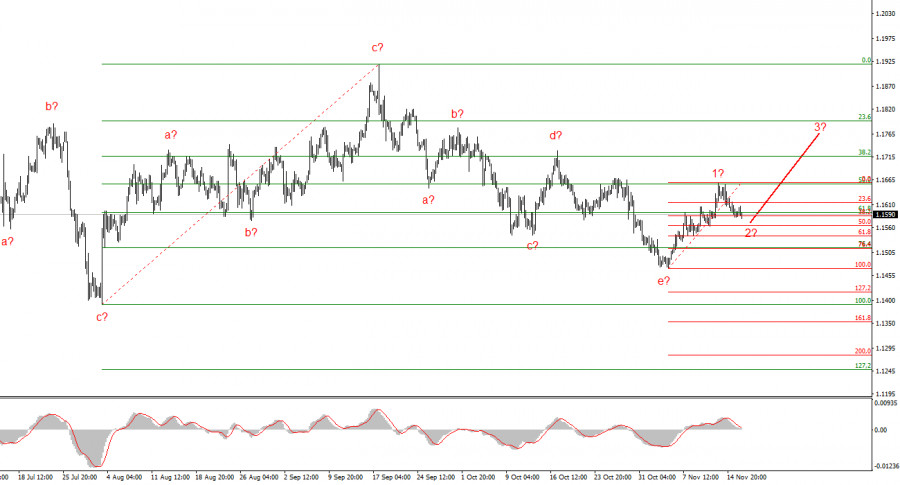

Based on the analysis conducted on EUR/USD, the instrument continues to build an upward section of the trend. In recent months, the market has paused, but Donald Trump's policies and the Fed's remain significant factors in the U.S. dollar's future decline. The targets for the current segment of the trend may stretch all the way to the 25-figure. A building upward wave sequence may begin now. I expect that from the area of 1.1541 – 1.1587, the third wave of this set will start forming, which may be either an impulse wave or a corrective wave. In any case, in the coming days, I am considering buying with targets around 1.1740.

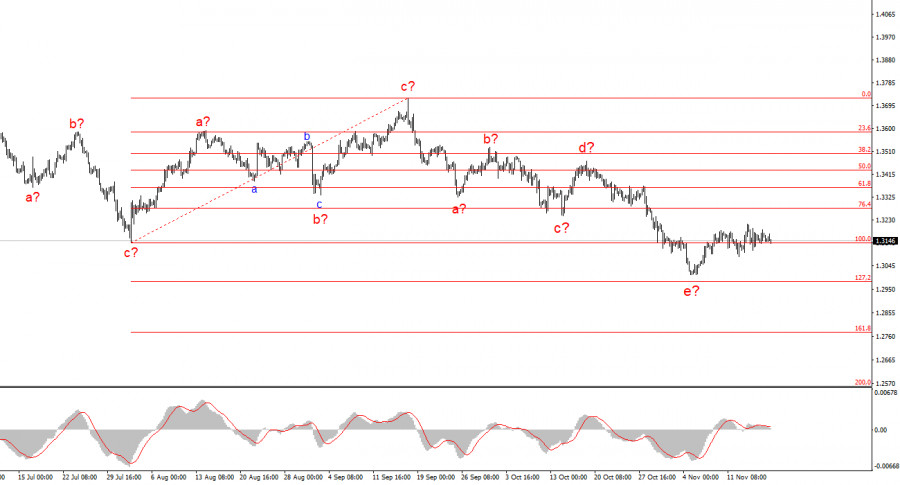

The wave structure of the GBP/USD instrument has transformed. We continue to deal with an upward, impulsive section of the trend, but its internal wave structure has become complicated. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in 4 is presumably complete. If this is indeed the case, I expect the main wave structure to resume its formation with initial targets around 38 and 40 figures. The key is that the news background should be at least a little better than last week.

LINKS RÁPIDOS