The EUR/USD currency pair continued to trade in an upward trend on Friday with low volatility. Volatility has been decreasing over the past three or four months, which aligns with the technical picture on the daily timeframe. It is important to note that we consider the current consolidation on the daily chart as a key moment for the EUR/USD pair. Almost all market movements depend on this consolidation.

The dollar had been rising for a month and a half. While it cannot be said that it rose significantly, it did so at a time when another decline would not have surprised anyone. The dollar gained strength during the longest government shutdown in U.S. history and while the Federal Reserve was cutting its key rate. However, when signals began to emerge from the Fed regarding a "pause" in December, and the shutdown was resolved, the dollar started to decline. As we see, there is absolutely no logic if we try to correlate fundamentals and macroeconomics with the movements of the pair.

Since there is no dependency between the news and movements, we continue to believe that market movements are purely technical. On the daily timeframe, within the range of 1.1400–1.1830, the pair has fallen close to the lower boundary, where a reversal was expected. It should be noted that within the flat, the price is not obligated to test each boundary of the channel. It is favorable when this occurs, but it doesn't happen all the time. Therefore, we witnessed a reversal near the lower boundary of the range, and overall, the pair hasn't been able to correct more than 23.6% on the Fibonacci scale within the upward trend of 2025. The dollar has been correcting for several months, but it has only managed to gain 23%.

Thus, in effect, the dollar is not gaining ground. It has remained stagnant for three months, waiting for a new decline. We do not doubt that this decline will occur. The global fundamental background has not changed at all in recent months. Trump is still waging trade battles with the world, demanding that all countries pay more into the American budget, and the Fed will continue to ease monetary policy (even if not in December), while 2026 threatens the dollar with a new batch of problems.

It's worth recalling that next year, Fed Chair Jerome Powell will depart, and a new head appointed by Trump will take over. This new leader will likely support maximum interest rate cuts. It is one thing to oppose Trump's views, which have no influence on the Fed's monetary committee. It's another for the Fed Chair to disagree. We consider the scenario where some FOMC officials change their opinion to a more dovish stance with the arrival of the new director to be quite realistic. In any case, the easing of Fed monetary policy will continue, unlike the European Central Bank. The gap between rates will narrow, and at some point the Fed may even "outpace" the ECB on the key interest rate.

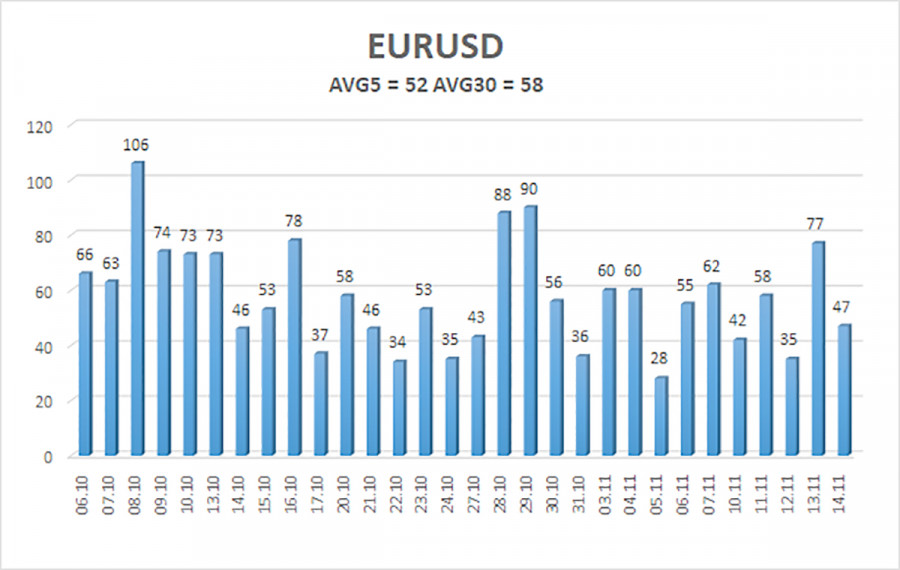

The average volatility of the EUR/USD currency pair over the last five trading days as of November 17 is 52 pips, which is considered "average." We expect the pair to trade between 1.1568 and 1.1672 on Monday. The higher regression channel is directed downwards, signaling a bearish tendency; however, the flat continues on the daily timeframe. The CCI indicator entered the oversold territory twice in October, which could trigger a new upward trend for 2025.

The EUR/USD pair has once again consolidated above the moving average, and the upward trend remains intact on all higher timeframes, while the daily timeframe has been flat for several months. The global fundamental background continues to strongly influence the dollar. Recently, the dollar has risen, but the reasons for such movement could be purely technical. If the price is positioned below the moving average, small short positions may be considered targeting 1.1536 on purely technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

LINKS RÁPIDOS