Jerome Powell directly stated that, in the absence of data, the Federal Reserve cannot form an opinion about the state of the economy. If it cannot, then it must "slow down" and exercise caution. After all, the Fed Chair has openly communicated that the possibility of a rate cut at the next meeting is uncertain, but the market misinterpreted this information once again.

The FOMC chair meant that conclusions can and should only be drawn when the flow of economic data resumes. He simply does not know what the Fed's decision will be in December. If the "shutdown" lasts until December 10, the Fed will likely not risk conducting a third consecutive round of policy easing. However, if the "shutdown" ends by that time, and both the Fed and the market receive all the missing reports, then the complete picture will become clear. In other words, Powell neither promised nor hinted at either a rate cut or keeping it unchanged. The FOMC and the committee simply do not have all the information to make any forecasts.

Also of interest were the voting results on the rate among FOMC leaders. Naturally, Stephen Miran voted for a 50-basis-point cut, which surprised no one. What was surprising was Jeffrey Schmidt's vote to keep the rate unchanged. This indicates that some Fed officials are already ready to "hit the brakes." The other members voted for a 25-basis-point cut, which was the baseline and the only possible scenario.

The "dovish wing" of the Fed does not currently pose a threat to monetary policy. It is worth noting that only three members of the FOMC are willing to vote for rate cuts at every meeting, regardless of economic data: Michelle Bowman, Christopher Waller, and Stephen Miran. At this point, it can even be said how these policymakers will vote at upcoming meetings. Miran will demand a 50-point cut, while Waller and Bowman will advocate for a 25-point cut. Nine Fed officials are still paying attention to economic data and are not oblivious to the rising inflation.

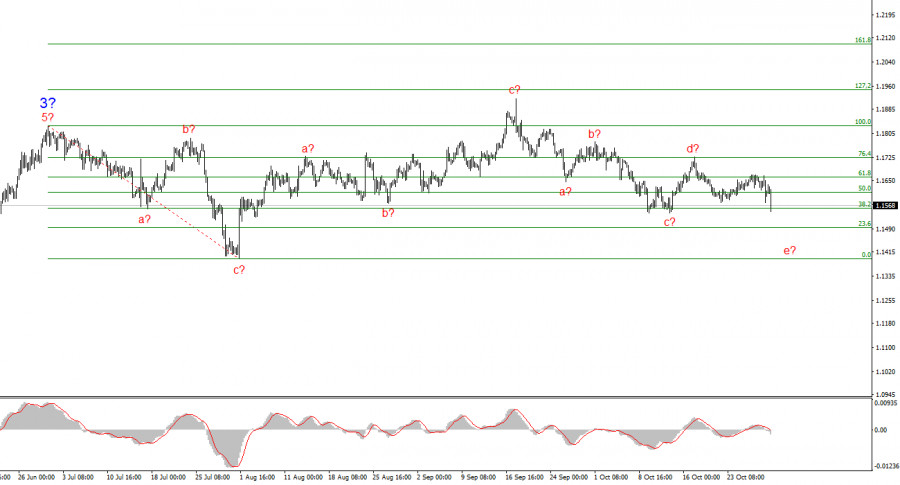

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the decline of the US currency. The targets for the current segment of the trend could reach up to the 25 figure. At the moment, we can observe the formation of correction wave 4, which is taking on a very complex and elongated shape. Therefore, I continue to consider only buying in the near term. By the end of the year, I expect the euro currency to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

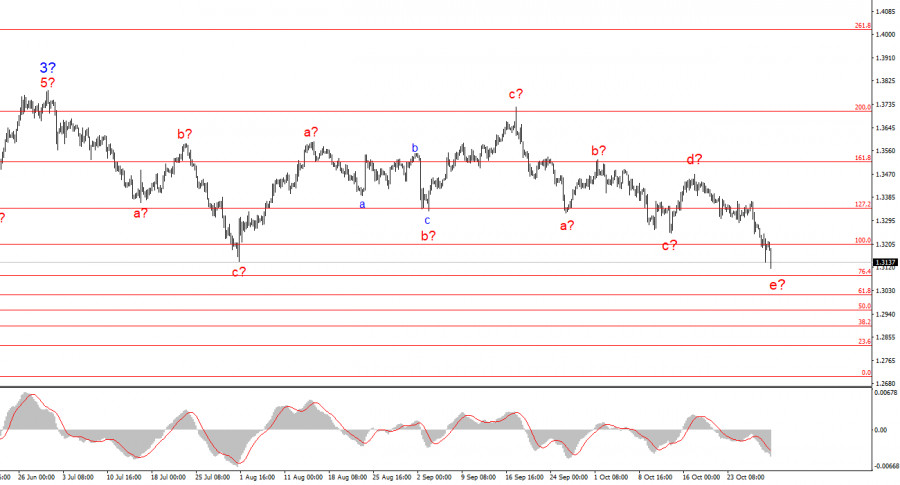

The wave picture for the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is significantly more elongated than wave 2's. Another downward corrective structure is nearing completion, but it could complicate a few more times. If this indeed happens, the rise of the instrument within the global wave structure may resume with initial targets around the 38 and 40 figures. However, the correction is still ongoing at this time.

LINKS RÁPIDOS