Francouzská skupina Legrand, která se zabývá elektrickou a digitální infrastrukturou budov, zvýší ceny, upraví dodavatelské řetězce a zmrazí výdaje, aby kompenzovala náklady ve výši až 200 milionů dolarů způsobené americkými cly na čínský dovoz, řekl agentuře Reuters generální ředitel Benoît Coquart.

Legrand nyní očekává, že finanční dopad amerických cel na čínský dovoz bude v letošním roce činit přibližně 150 až 200 milionů dolarů na upravený zisk před úroky a daněmi, a to na základě předpokladu, že oznámené 145% americké clo na čínské zboží klesne v průběhu roku na 50–60 %, uvedl Coquart v rozhovoru pro agenturu Reuters v souvislosti se středečními výsledky skupiny.

On Friday, the EUR/USD currency pair began a new leg of upward correction within the broader downward trend. In simpler terms, the recent decline of the euro over the past several weeks is either part of a larger correction or simply a phase of sideways consolidation on higher timeframes.

As mentioned previously, the current drop in the euro is illogical. A continuous stream of U.S. news has been pushing traders toward only one action—selling the dollar. Yet on the daily timeframe, in conditions of a flat market, price movement in either direction doesn't require macroeconomic or fundamental reasoning. The key question is: when will the flat end?

The primary goal for traders right now is to be ready for a possible resumption of the uptrend and to recognize that the fall in the euro is entirely against the grain—unsupported by fundamentals or macro data.

On Friday, the only economic release was the University of Michigan Consumer Sentiment Index, which beat expectations—but the dollar was already falling that day. There is no clear logic in the current movements.

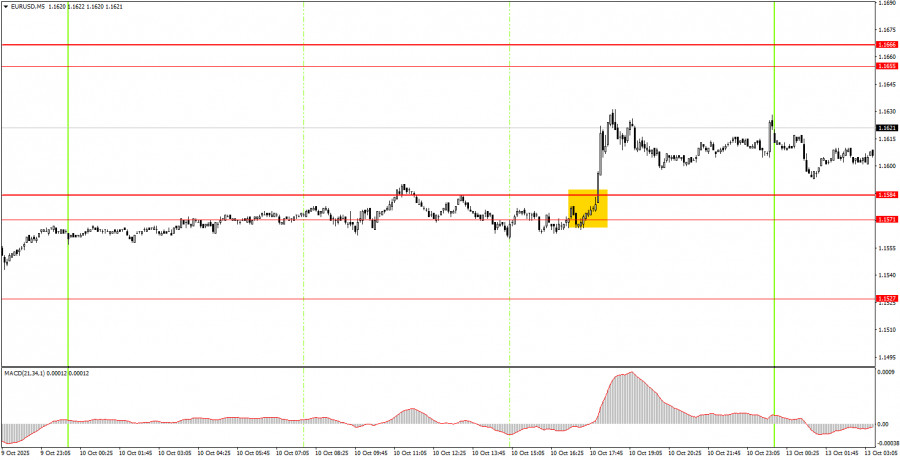

On the 5-minute timeframe, most of Friday's session was spent in sideways movement between the 1.1571–1.1584 range. When Trump announced new tariffs on China, the U.S. dollar came under pressure; however, the sell-off was short-lived.

Novice traders might have opened long positions, which—given the Stop Loss was moved to breakeven—could have been left open until Monday. We expect continued growth in the pair.

On the hourly timeframe, EUR/USD has punctured the trendline multiple times but resumed its decline for unclear reasons. We view the current movement as entirely illogical. The overall fundamental and macroeconomic backdrop remains highly unfavorable for the U.S. dollar, and we do not expect any sustained appreciation of the greenback. From our point of view, just like before, the dollar can only count on technical corrections—one of which we are observing now.

On Monday, EUR/USD may move in either direction. There is little logic and a great deal of uncertainty in the market right now. A correction is likely to continue after the prolonged decline, especially following Trump's announcement of new tariffs. Therefore, we expect another wave of growth, at least toward the 1.1655–1.1666 area.

On the 5-minute timeframe, the following levels should be monitored: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. No significant events are scheduled in either the U.S. or the Eurozone on Monday, which means volatility may be limited.

Important speeches and economic releases (always listed in the news calendar) can significantly impact currency movement. Traders should be especially cautious or exit positions before such events to avoid sudden price reversals.

Beginner traders in the forex market must remember: not every trade will be profitable. Developing a clear strategy and applying sound money management principles are keys to long-term success in trading.

LINKS RÁPIDOS