uznaná vláda, v sobotním prohlášení uvedl, že odstoupil poté, co čelil „mnoha obtížím“, včetně nemožnosti provést vládní reorganizaci.

Jeho odchod následuje po konfliktu s Rashadem Al-Alimim, předsedou prezidentské rady Jemenu, ohledně jeho pravomocí poté, co Al-Alimi odmítl Mubarakovu žádost o odvolání 12 ministrů vlády, uvedlo šest vládních zdrojů agentuře Reuters.

Uvedly, že novým premiérem by měl být jmenován ministr financí Salem Saleh Bin Braik.

Mubarak byl jmenován premiérem v únoru 2024 poté, co působil jako ministr zahraničí. Do popředí se dostal v roce 2015, kdy byl unesen milicí Houthi spojenou s Íránem, zatímco působil jako šéf prezidentské kanceláře Jemenu během konfliktu Houthiů s tehdejším prezidentem Abd-Rabbu Mansourem Hadim.

Two days remain before the deadline, yet amid recent headlines, the market has almost overlooked the approaching new fiscal year in the U.S. By itself, the start of the fiscal year is usually a formality, but in America, it has become an annual political standoff. Democrats and Republicans once again cannot agree on spending plans for the coming year. The Democratic Party demands the preservation of tax breaks and healthcare subsidies for the American population, while the Republican Party (read—Donald Trump) insists on cutting expenditures in precisely these areas.

Previously, Republicans passed most bills in both chambers of Congress with a simple majority. The situation is different now. To approve the budget for the next year, a two-thirds majority, or 60 votes, is required in the Senate. Usually, a simple majority of 50% + 1 is enough, but Trump lacks the 60 "loyal vassals" in the Senate. Democrats, fully aware of this leverage, are gladly blocking the budget and seizing the opportunity to influence policy.

It should be noted that Trump made most of the key decisions in 2025 independently, as both chambers of Congress held Republican majorities and voted accordingly. The budget, however, is an exception, requiring a two-thirds majority. Democrats understand that they can now obstruct the functioning of the current administration, which has already been marked by numerous controversial decisions.

In reality, a shutdown is politically advantageous for Democrats, as it forces Republicans to find common ground with them. Democrats can block the government's work indefinitely until their demands are met. Yet Trump is far from passive. He has already warned of mass layoffs of federal employees, framing Democrats as responsible for job losses among "loyal public servants."

From all this, I conclude that the shutdown is likely to be protracted, and Trump will now be forced to battle not only the Federal Reserve but also the Democrats. As for the impact on the dollar, if, as early as the day after tomorrow, many U.S. government agencies grind to a halt, the implications are obvious.

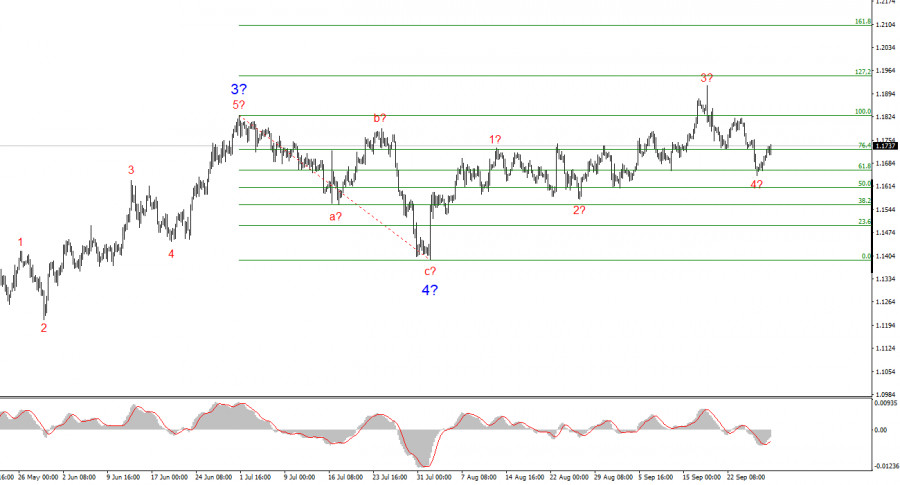

Based on my analysis of EUR/USD, the instrument continues to build an upward trend segment. The wave markup still depends entirely on the news background linked to Trump's decisions and the policies of the new White House administration. Targets for the current trend may extend up to the 1.2500 area. At present, a corrective Wave 4 may already be complete. The bullish wave structure remains valid. Thus, in the near term, I am considering only buying. By year-end, I expect the euro to rise to 1.2245, corresponding to the 200.0% Fibonacci.

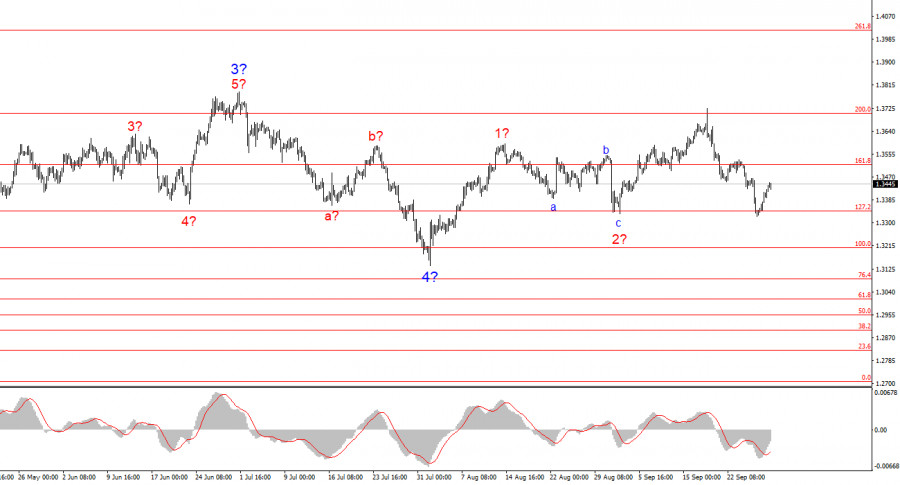

The wave picture for GBP/USD has evolved. The pair remains in an upward impulsive segment, but its internal structure has become less clear. If Wave 4 takes the form of a complex three-wave correction, the structure will normalize, though this would make Wave 4 significantly larger and more complex than Wave 2. In my view, the key reference point now is 1.3341 (127.2% Fibonacci). Two failed attempts to break above this level may indicate that the market is ready for renewed buying.

LINKS RÁPIDOS