The American tariff drama continues and is only gaining momentum. To recap: several months ago, twelve Democratic governors filed a lawsuit in the International Trade Court against Donald Trump, arguing that the U.S. president does not have the right to impose trade tariffs against entire industries or specific countries. The Trade Court upheld the Democrats' claim, declared Trump's actions illegal, but left the tariffs in place, shifting responsibility for lifting them to the Court of Appeals — where Trump immediately filed an appeal.

Some time later, the Appeals Court delivered a similar verdict: Trump's tariffs (with some exceptions) are illegal, and the 1974 Emergency Act has no provisions allowing the president to start a trade war without Congressional approval. However, even while acknowledging their illegality, the Appeals Court did not cancel the tariffs, postponing the decision until October 14th to allow Donald Trump to file one more appeal, this time to the U.S. Supreme Court.

Now, the fate of Trump's tariffs will be decided in Washington, in the last possible instance. If Trump loses at the Supreme Court, what would happen if all U.S. courts were to declare the tariffs illegal? Many might assume that the tariffs will become void. But what about all the money the government has already collected from Americans when purchasing foreign goods? Can you imagine the potential number of lawsuits against the U.S. president if the Supreme Court rules any trade tariffs illegal?

In this case, almost any American or U.S. company connected to imports could demand compensation and a refund of "excess" payments. In other words, all collected tariffs would have to be returned to their rightful owners. Additionally, companies could seek compensation for losses stemming from decreased demand for their products due to higher prices caused by the tariffs.

U.S. Treasury Secretary Scott Besant has confirmed that if the Court rules tariffs illegal, the U.S. budget would have to return the collected funds. "We would have to refund approximately 50% of the tax revenues, which would be catastrophic for the treasury," said Besant. Frankly, I'm not exactly sure what he means by "tax revenues," but the word "catastrophe" is no exaggeration in this context.

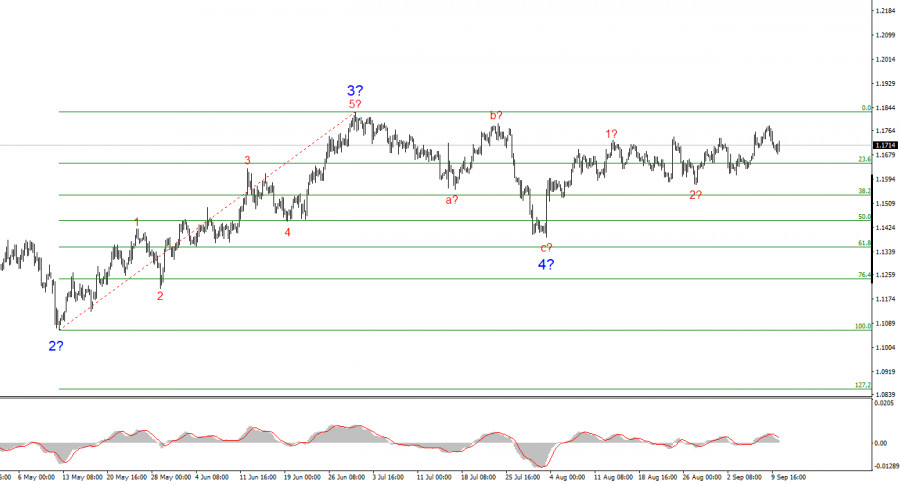

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. The wave pattern remains entirely dependent on the news background related to Trump's decisions and U.S. foreign policy. The targets for this trend segment could extend up to the 1.25 area. Therefore, I continue to consider purchases with targets near 1.1875 (the 161.8% Fibonacci level) and above. I believe wave 4 formation is complete, making now still a good time to buy.

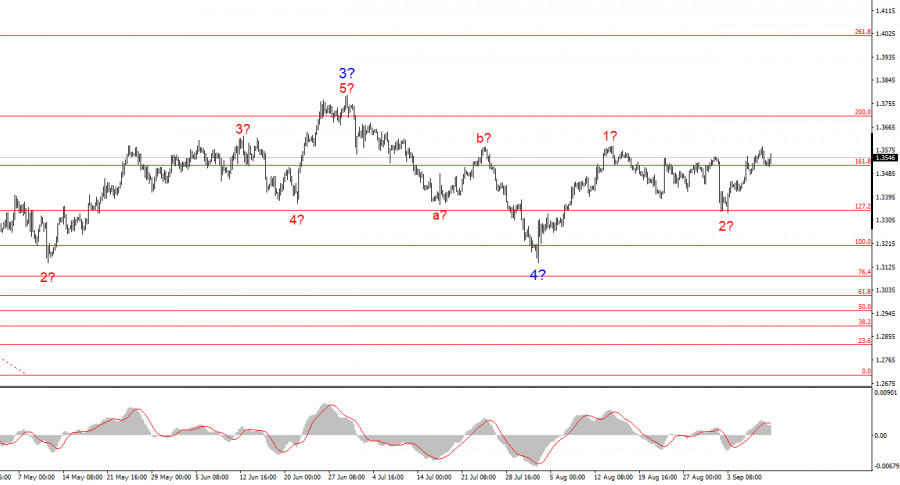

The wave picture for GBP/USD remains unchanged. We are still dealing with an upward impulsive segment of the trend. With Donald Trump, markets may be in for many more shocks and reversals that could seriously affect the wave structure, but for now, the working scenario remains intact. The current targets for the uptrend segment are now around 1.4017. At this time, I believe the downward wave 4 is complete. Wave 2 of 5 may also be finished or nearing completion. Therefore, I recommend buying with a target of 1.4017.

LINKS RÁPIDOS