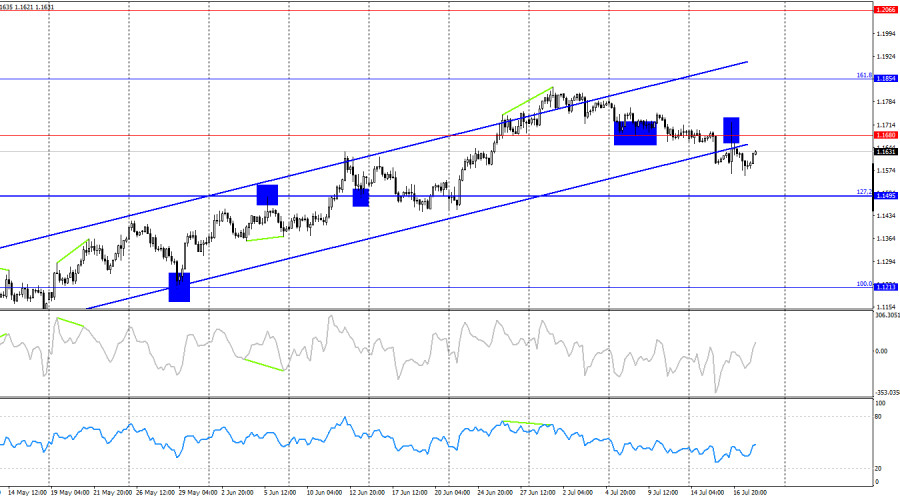

On Thursday, the EUR/USD pair returned to the 100.0% corrective level at 1.1574 and bounced off it for the second time in a row. This resulted in a reversal in favor of the euro and the beginning of a new upward movement toward the 1.1645 level. A rebound from this level would favor the U.S. dollar and a third return to 1.1574. A consolidation above 1.1645 would increase the likelihood of continued growth toward the 127.2% Fibonacci level at 1.1712.

The wave pattern on the hourly chart remains simple and clear. The last completed downward wave did not break below the low of the previous one, and the most recent upward wave did not exceed the previous peak. Thus, the trend remains bullish for now, despite a prolonged correction. The lack of real progress in U.S. trade negotiations, the low probability of trade agreements with most countries, and the introduction of new tariffs continue to cast a bleak outlook for the bears, even though they have been on the offensive in recent weeks.

Over the past several weeks, the U.S. dollar has been actively strengthening, although the news backdrop has not always supported this movement. Yesterday, the bears launched another attack for most of the day, supported only by better-than-expected U.S. retail sales data. However, economic reports are currently not the top priority for traders. On Wednesday evening, Donald Trump once again mentioned the potential departure of Jerome Powell—while tactfully omitting the fact that he himself is doing everything possible to push Powell out. Trump is trying to frame the situation as if Powell may step down voluntarily or be forced to leave. But the market is already growing weary of this story. The dollar is already under pressure, and if the Federal Reserve loses its independence and the market realizes that Trump is now controlling the central bank too, the bears may go into hiding for a long time. In my view, the trade war has not yet ceased to weigh on the dollar. The ongoing conflict between Powell and Trump also undermines confidence in the U.S. currency.

On the 4-hour chart, the pair has consolidated below the 1.1680 level and below the ascending trend channel. This suggests that the bullish trend is beginning to shift to bearish, based on the technical picture. Despite the U.S. dollar rising for the third consecutive week, its fundamental foundation remains weak. The current dollar growth still appears to be a typical corrective pullback. The underlying problems with the U.S. currency have not gone away.

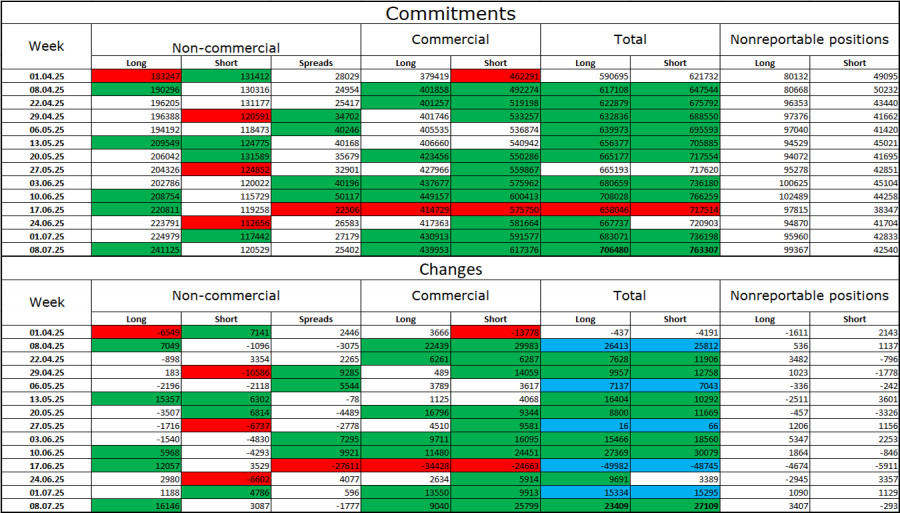

Commitments of Traders (COT) Report:

During the last reporting week, professional traders opened 1,188 long positions and 4,786 short positions. The sentiment of the "Non-commercial" group remains bullish, driven by Donald Trump's policies, and has only strengthened over time. The total number of long positions held by speculators now stands at 225,000, while short positions total 117,000—and this gap (with few exceptions) continues to widen. This indicates ongoing demand for the euro, while the dollar remains out of favor. The situation remains unchanged.

For 22 consecutive weeks, large players have been reducing short positions and increasing long ones. The divergence in monetary policy between the ECB and the Fed is significant, but Donald Trump's policy is a more influential factor for traders, as it may lead to a U.S. recession and other long-term structural issues for the American economy.

Economic Calendar for the U.S. and the Eurozone:

On July 18, the economic calendar includes three entries, none of which are considered significant. The news background will have only a minor influence on market sentiment, and only in the second half of the day.

EUR/USD Forecast and Trader Recommendations:

I do not recommend selling the pair today, as the movement in recent weeks has been too weak and unstable. Buying opportunities were available on a rebound from the 1.1574 level on the hourly chart, targeting 1.1645. These trades can remain open today. New buying opportunities will arise upon a close above 1.1645, with a target of 1.1712.

LINKS RÁPIDOS