Today, on Wednesday, the GBP/JPY pair is rising for the second consecutive day, having surpassed the round level of 207.00 within the day. At the current moment, the pair is pulling back, as the presence of conflicting factors requires traders to exercise caution.

The British pound is supported by the resolution of uncertainty surrounding the UK's fiscal policy, as well as by the weakening of the U.S. dollar. These are considered key drivers behind the upward movement of the GBP/JPY pair. However, expectations of an interest rate cut by the Bank of England as early as the end of this month—triggered by easing inflation and a cooling labor market—are discouraging pound bulls from acting too aggressively.

Meanwhile, the Japanese yen remains relatively strong due to the Bank of Japan's hawkish domestic policy outlook, which limits further appreciation of the GBP/JPY pair. On Tuesday, Bank of Japan Governor Kazuo Ueda noted that the likelihood of the regulator's economic and price forecasts materializing is increasing. This signal is interpreted as a sign of possible rate hikes, which supports the yen.

An additional factor is the geopolitical risk associated with the prolonged Russia–Ukraine conflict and the potential escalation of hostilities, which reinforces the yen's status as a safe-haven currency. Under these conditions, it is advisable to exercise caution before making strong bullish forecasts for GBP/JPY.

From a technical standpoint, oscillators on the daily chart are positive. The round level of 207.00 acted as a barrier for the pair, followed by the next resistance at 207.20. After that, prices may target the next round level of 208.00, which was last year's high.

The pair will find support at 206.40. The next support lies at the round level of 206.00, where the 9-day EMA currently runs. If prices fail to hold this level, they may fall toward the 14-day EMA, where bulls will begin to lose strength.

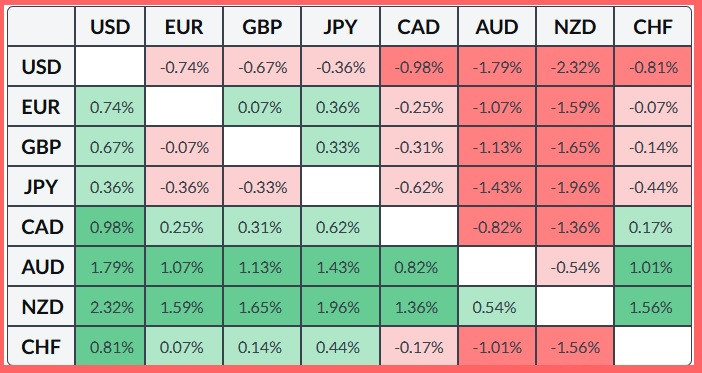

Below is a table showing percentage changes in the Japanese yen exchange rate against major currencies over the past 7 days. The most notable strengthening was recorded against the U.S. dollar.

SZYBKIE LINKI