The GBP/USD currency pair traded quite calmly again on Thursday, although when the US inflation data came out, the price began to swing sharply. The August consumer price index was 2.9% y/y, which overall is in line with forecasts. Core inflation remained at 3.1%, also as expected. So in general, US inflation didn't surprise anyone. However, in recent years, inflation has been mainly interesting to traders because of its massive influence on the Fed's monetary policy. With Donald Trump's arrival, the situation has changed dramatically, making the consumer price index just another ordinary report.

Let's start with the fact that Trump's policy helps fuel consumer price increases. Since high inflation is universally seen as a negative, Trump prefers to act as if there's no inflation in America. Yes, apparently, that's how you "solve" the problem. Prices rise, tariffs make about half of imported goods and goods produced with imported materials more expensive, but Trump says there's no inflation—so there isn't.

The US President never misses a chance to embed the "no inflation" idea in voters' minds. For example, on Wednesday, when the producer price index dropped by 0.1%, Trump immediately posted on Truth Social that there's no inflation. However, a month earlier, when the PPI saw an unprecedented 0.9% jump, Trump did not comment. On Thursday, when inflation jumped to 2.9%, Trump also said nothing. Why comment on numbers that contradict the President's narrative?

Let's also recall the firing of Erika McEntarfer "for falsifying official statistics". Naturally, there was no falsification, nor any manipulation in the cases of Jerome Powell or Lisa Cook. However, Trump does have the authority to fire the head of the Bureau of Labor Statistics, so McEntarfer was simply unlucky.

Since there's "no inflation in the US", Trump sees no reason for the Fed to keep rates at current levels. Even if the Fed cuts rates twice before year-end, it won't be enough for the US President. That's why he is seeking to fire as many FOMC members as possible, aiming to replace them with "his people" who will vote as desired. But even here, things aren't going smoothly for Trump: he failed to oust Lisa Cook, even through the courts, for lack of strong evidence. Jerome Powell refused to step down, and no Trump official wanted to launch an official investigation into supposed manipulation by the Fed Chair regarding central bank building renovations.

Thus, at this point, it simply doesn't matter what Trump thinks about inflation—or what the actual level of inflation in the US is. The Fed's task is to stop the decline in the labor market without causing even higher price growth. Hence, at best, we'll see two rate cuts by year-end.

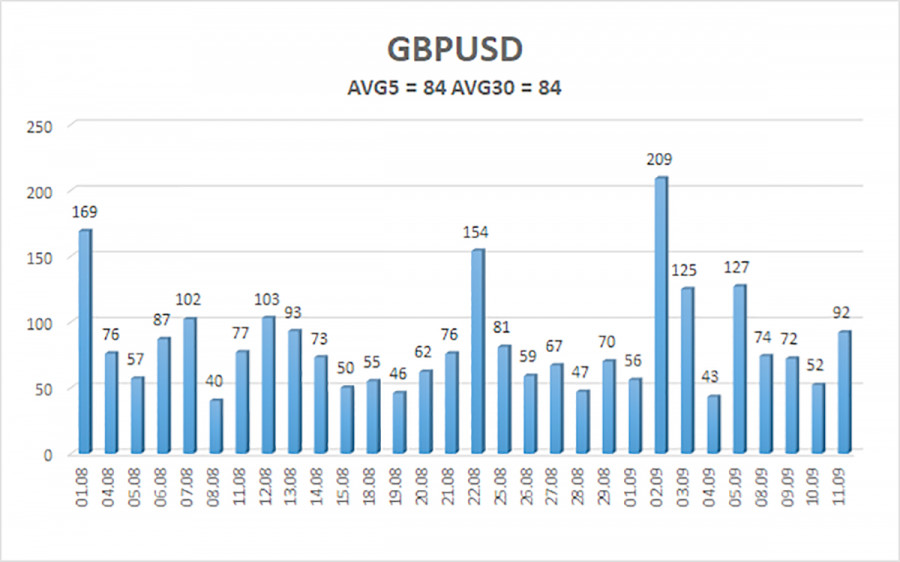

The average volatility for GBP/USD over the last five trading days is 84 pips. For the pair, this is considered "average". On Friday, September 12, we expect movement inside the 1.3492–1.3660 range. The linear regression channel's upper band is pointing upward, indicating a clear uptrend. The CCI indicator once again entered the oversold zone, warning again of the resumption of the uptrend.

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

The GBP/USD pair is again looking to continue its uptrend. In the medium term, Trump's policy will probably keep pressuring the dollar, so we don't expect dollar growth. Thus, long positions with targets at 1.3611 and 1.3672 remain most relevant if the price is above the moving average. If the price is below the moving average, small shorts may be considered on purely technical grounds. From time to time, the dollar will show corrections, but for a sustained uptrend, it will need evidence of a true end to the World Trade War or some other major positive factors.

فوری رابطے