In addition to financial losses, the U.S. has already suffered reputational damage either way. What happens with trade agreements worth hundreds of billions of dollars that have been signed? After all, these also involve specific tariffs. What about retaliatory tariffs? Donald Trump "stirred the pot," but how to "clean up the mess" remains entirely unclear.

In the 1974 Act (IEEPA), there really are no references to the president having the authority to enact trade measures unilaterally. However, it is essential to recognize that America, like many countries worldwide, faces issues that cannot always be resolved legally or fairly. For example, some economists have noted that six out of nine Supreme Court justices were appointed at different times by Republican presidents. This means we can expect some loyalty to the sitting U.S. president from them.

Trump has demonstrated how he can operate through his dealings with the Federal Reserve. If an official refuses to follow Trump's "strong advice", they are quickly branded as schemers or frauds. Therefore, I would not be surprised if, should the Supreme Court side against the administration, Trump attempts to fire several sitting justices. Naturally, he has no such authority—just as he has no authority to dismiss Fed Governors. So, we can expect various investigations against "disobedient" and "unpatriotic" justices, during which many "skeletons in the closet" may be found.

Given all this, I believe Trump will not abandon his policy. He will fight in court to the very end. If he loses, he will seek alternative methods to pressure countries worldwide. It's also likely that trade deals already signed with the EU, UK, Japan, South Korea, and others could be canceled or renegotiated, as they would become illegal. The dollar could be in for a new whirlwind of events. If the tariffs are lifted, demand for the U.S. dollar could rise. But any new move by Trump aimed at destabilizing the global order and changing trade architecture would immediately trigger a new wave of dollar depreciation.

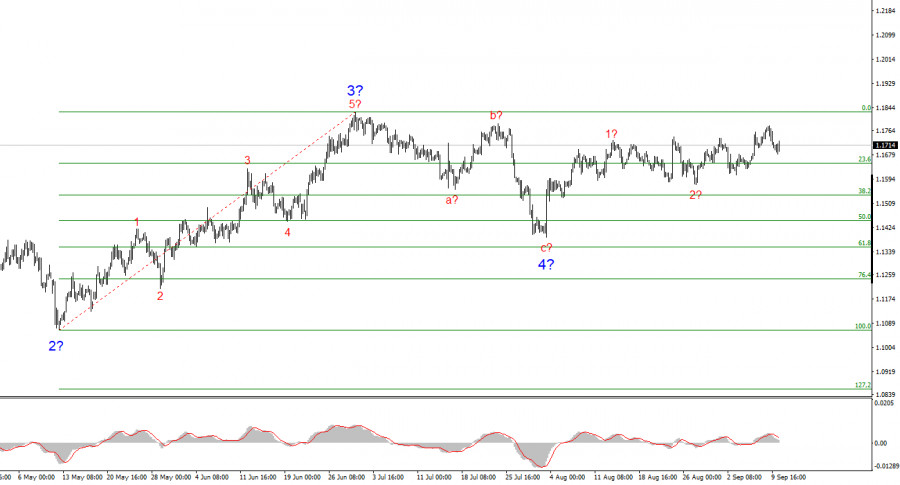

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. The wave pattern remains entirely dependent on the news background related to Trump's decisions and U.S. foreign policy. The targets for this trend segment could extend up to the 1.25 area. Therefore, I continue to consider purchases with targets near 1.1875 (the 161.8% Fibonacci level) and above. I believe wave 4 formation is complete, making now still a good time to buy.

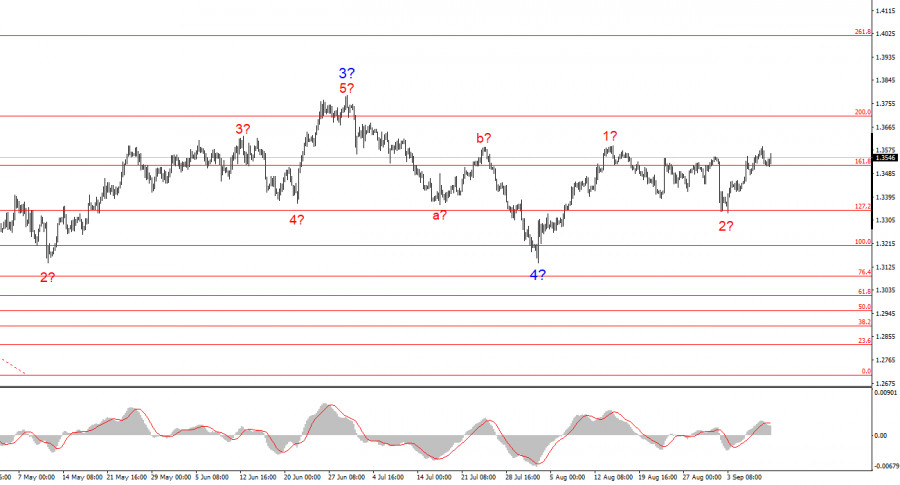

The wave picture for GBP/USD remains unchanged. We are still dealing with an upward impulsive segment of the trend. With Trump, markets may be in for many more shocks and reversals that could seriously affect the wave structure, but for now, the working scenario remains intact. The current targets for the uptrend segment are now around 1.4017. At this time, I believe the downward wave 4 is complete. Wave 2 of 5 may also be finished or nearing completion. Therefore, I recommend buying with a target of 1.4017.

فوری رابطے