Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Globální akcie zakončily nejhorší čtvrtletí od roku 2023, přičemž index MSCI All-Country World Equity Index v březnu poklesl o 4,4 %.

Nejvíce byly zasaženy americké akcie, když index S&P 500 během měsíce klesl o 5,6 % a za celé čtvrtletí o 4,3 % – což je nejprudší pokles od roku 2022. Eskalace obchodního napětí, rostoucí obavy ze stagflace a nejistota ohledně budoucnosti monetizace umělé inteligence silně zatížily sentiment.

Trhy otřásla rychlejší než očekávaná oznámení cel ze strany USA. 25 % clo na zahraniční automobily následovalo po nových odvodech na dovoz z Mexika, Kanady a Číny.

Další rozsáhlé kolo obchodních opatření se od Bílého domu očekává 2. dubna.

Trade Review and Guidance for Trading the Japanese Yen

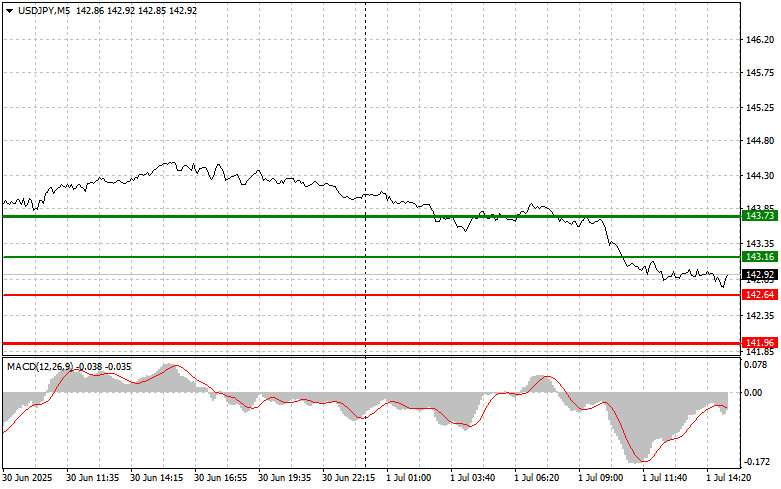

The test of the 143.64 price level coincided with the MACD indicator beginning its downward movement from the zero line, confirming a correct entry point for selling the dollar and resulting in a drop of more than 70 points in the pair.

In the second half of the day, investors will focus on Federal Reserve Chair Jerome Powell's speech, as well as the ISM Manufacturing PMI and the JOLTS report from the U.S. Bureau of Labor Statistics. Powell's comments will be closely examined for signals regarding the Fed's future monetary policy. Most likely, any signs of a more dovish stance will lead to a weakening of the dollar and a strengthening of the yen.

The ISM Manufacturing Index is a key indicator reflecting the state of the U.S. economy. A reading above 50 points indicates manufacturing expansion, while a reading below 50 signals contraction.

The JOLTS report will provide insights into labor market conditions. A high number of job openings suggests a labor shortage and could fuel inflation. A decline in vacancies, on the other hand, may indicate slowing economic growth. The market's reaction to these data is expected to be limited.

As for today's intraday strategy, I'll be focusing primarily on executing Scenarios #1 and #2.

Buy Signal

Scenario #1:I plan to buy USD/JPY today at the entry point around 143.16 (green line on the chart), targeting a rise to 143.73 (thicker green line). At 143.73, I will exit long positions and open shorts in the opposite direction, aiming for a 30–35 point correction. A strong rise in the pair today is only likely if U.S. data comes in strong.Important! Before buying, ensure that the MACD indicator is above the zero line and just starting to rise.

Scenario #2:I also plan to buy USD/JPY if there are two consecutive tests of the 142.64 price level and the MACD is in oversold territory. This would limit the pair's downward potential and lead to a reversal to the upside. A rise toward 143.16 and 143.63 can be expected.

Sell Signal

Scenario #1:I plan to sell USD/JPY today after a move below 142.64 (red line on the chart), which could trigger a rapid decline in the pair. The key target for sellers will be 141.96, where I will exit short positions and immediately open long positions in the opposite direction, targeting a 20–25 point rebound. Selling pressure is likely to return if U.S. data is weak.Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline.

Scenario #2:I also plan to sell USD/JPY today if there are two consecutive tests of the 143.16 level while the MACD is in overbought territory. This would limit the pair's upward potential and lead to a reversal to the downside. A decline toward 142.64 and 141.96 can be expected.

Chart Legend:

Important Note for Beginner Forex Traders:

Beginner traders should be extremely cautious when making entry decisions. It's generally better to stay out of the market ahead of major fundamental releases to avoid sharp price swings. If you choose to trade during news events, always use stop-loss orders to limit potential losses. Without stop-losses, you may quickly lose your entire deposit—especially if you don't apply money management and trade with large volumes.

And remember: successful trading requires a clear plan—like the one provided above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

فوری رابطے