On the hourly chart, the GBP/USD pair experienced a drop to the corrective level of 61.8% (1.2715) on Monday, and today it has consolidated below it. Therefore, the downward process may continue towards the support zone of 1.2584-1.2611. I don't anticipate a new rise of the British pound just yet, but a consolidation above the level of 1.2715 would allow us to expect a return to the resistance zone of 1.2788-1.2801.

The wave situation remains very ambiguous. Trends are relatively short-term, and we often see single waves. The bullish sentiment persists due to the absence of a decline in the British pound. The last downward wave failed to break the level of 1.2611, around which the lows of all previous waves are located. The new upward wave broke the peak of the previous one, but it couldn't close above the resistance zone of 1.2788-1.2801, and the sideways movement persisted. We can expect a series of waves towards the support zone of 1.2584-1.2611. Neither bulls nor bears currently possess enough strength to initiate a new trend.

The information background on Monday needed to be stronger; it was absent. However, today marks the beginning of a period when several important reports will be released in the UK. On Tuesday, these reports will cover unemployment, unemployment claims, and wages, while inflation will be on the agenda on Wednesday. Thus, starting tomorrow in the second half of the day, traders may change their attitude toward the British pound, assuming that economic reports are weak. I expect a close below the 1.2584-1.2611 zone.

Nevertheless, we have clear graphical reference points for the current movement. There are two important zones around which rebounds and breakthroughs can occur. Currently, there are no graphical signals for forming a new trend, so horizontal movement is preserved.

On the 4-hour chart, the pair has experienced several rebounds to the Fibonacci level of 61.8% (1.2745). The new bounce from this level again favored the US dollar and initiated a new decline toward 1.2620. On the 4-hour chart, horizontal movement between the levels of 1.2620 and 1.2745 is visible. There are no imminent divergences with any indicators today, and the ascending trend corridor has been abandoned. The trend may continue to shift towards the bearish side, but this will take time and require significant efforts from the bears.

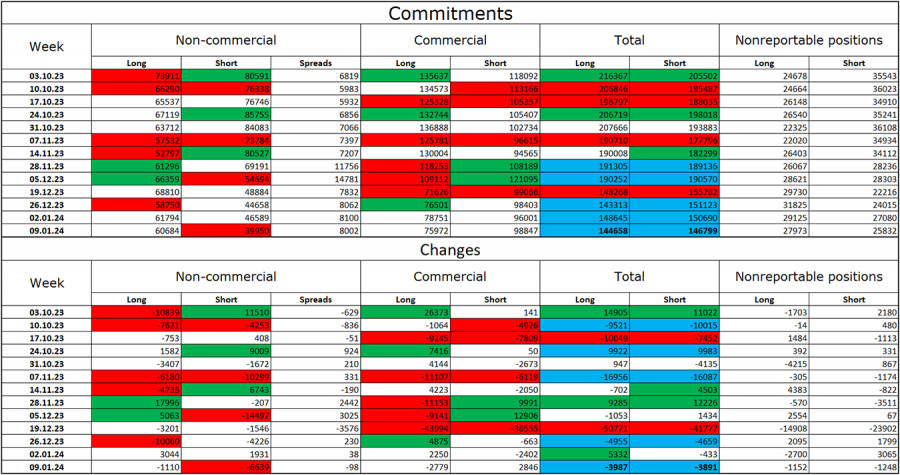

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category has shifted in favor of the bulls during the past reporting week. The number of long contracts held by speculators decreased by 1110 units, while the number of short contracts decreased by 6639. The overall sentiment of large players shifted to bearish a few months ago, but currently, bulls have a slight advantage. There is a gap between the number of long and short contracts: 60 thousand versus 39 thousand, but the gap is small and hardly increasing.

The prospects for a decline in the British pound remain excellent. Over time, bulls will continue to get rid of their buy positions because all possible factors for buying the British pound have already been exhausted. The growth we have seen in the last three months is corrective. Bulls have been unable to push through the 1.2745 level for over a month.

News Calendar for the US and the UK:

UK - Unemployment Rate (07:00 UTC).

UK - Change in Average Earnings (07:00 UTC).

UK - Change in Unemployment Claims (07:00 UTC).

UK - Speech by Bank of England Governor Andrew Bailey (15:00 UTC).

On Tuesday, the economic events calendar contains four important entries for Britain. The impact of the information background on market sentiment today can be quite significant.

GBP/USD Forecast and Trader Recommendations:

Selling the British pound was possible around the 1.2788-1.2801 zone on the hourly chart with a target of 1.2715. Holding the sell positions is possible with a target of 1.2611 since bears have consolidated below 1.2715. Buying the British pound will be possible in case of a rebound from the 1.2584-1.2611 zone with a target of 1.2715.

فوری رابطے