A considerable number of macroeconomic reports are scheduled for Friday. In the European Union, Germany, the UK, and the US, indices of business activity in the services and manufacturing sectors will be published. It is worth noting that the first estimates (which will be published today) are significant for the market, but in the US, there are more important business activity indicators – ISM. Additionally, a retail sales report will be released in the UK, and in the US, the University of Michigan's consumer sentiment index will be published. All these reports have a medium degree of significance but can provoke a measured market reaction.

A considerable number of fundamental events are again scheduled for Friday. We have upcoming speeches from representatives of the Federal Reserve, including Barr, Jefferson, Williams, Collins, and Logan. However, we are already well acquainted with the Fed's Monetary Committee's stance on the key interest rate. This stance is that the central bank wants to keep the rate unchanged in December, but the final decision will be made after the November employment and unemployment data, as well as inflation data, become available. Therefore, any assumptions about what decision the Fed may make on December 10 can only be constructed at the beginning of December. Today, there will also be a speech by European Central Bank President Christine Lagarde, but this event does not arouse particular interest.

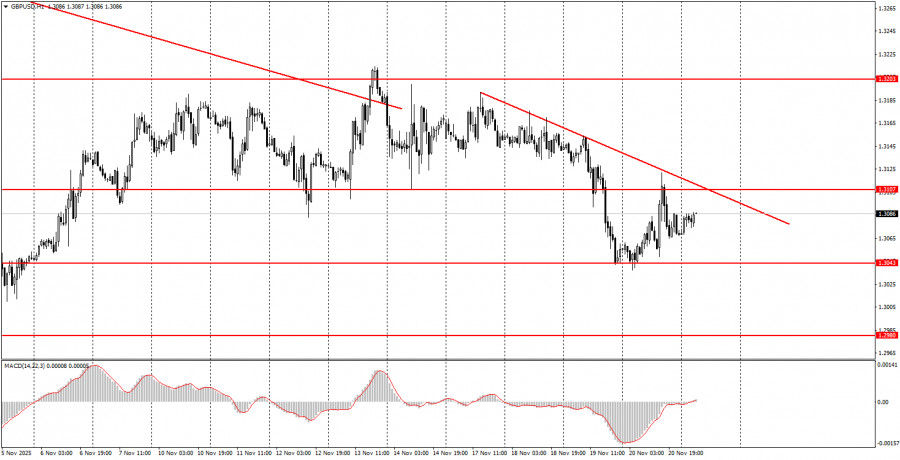

During the last trading day of the week, both currency pairs can exhibit absolutely any movements, as the macroeconomic backdrop will be abundant today. The euro has a great trading area around 1.1527-1.1531. The British pound is trading around 1.3096-1.3107. However, it should be noted that market volatility is low at the moment, regardless of the strength and volume of macroeconomic data.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

QUICK LINKS