Praha – České zbrojařské skupině STV Group loni stoupl čistý zisk na 5,5 miliardy korun z předloňských 1,5 miliardy korun. Konsolidované tržby dosáhly téměř 14 miliard korun, zatímco v roce 2023 to byly podle výroční zprávy přibližně čtyři miliardy Kč. Hospodářské výsledky za loňský rok sdělil šéf firmy Martin Drda deníku Právo. STV Group je jediným výrobcem velkorážní munice v Česku. Přes 90 procent tržeb loni pocházelo z exportu. České armádě STV Group dodala materiál v hodnotě 580 milionů korun.

There are a lot of macroeconomic reports scheduled for Friday, which is rather unusual. In Germany, a second, relatively minor estimate for August inflation will be released. In the UK, there will be low-importance monthly reports on GDP and industrial production. In the US, there's the not-so-important University of Michigan Consumer Sentiment Index. In all cases, significant market reaction is only possible if there is a serious deviation from forecasted values.

There is nothing notable among fundamental events for Friday. The ECB meeting was just yesterday, so the market has already absorbed all necessary information. The Fed meeting will be held next week, which means FOMC members are not permitted to give any comments or interviews at present. On Friday, traders can focus on only a few non-critical reports.

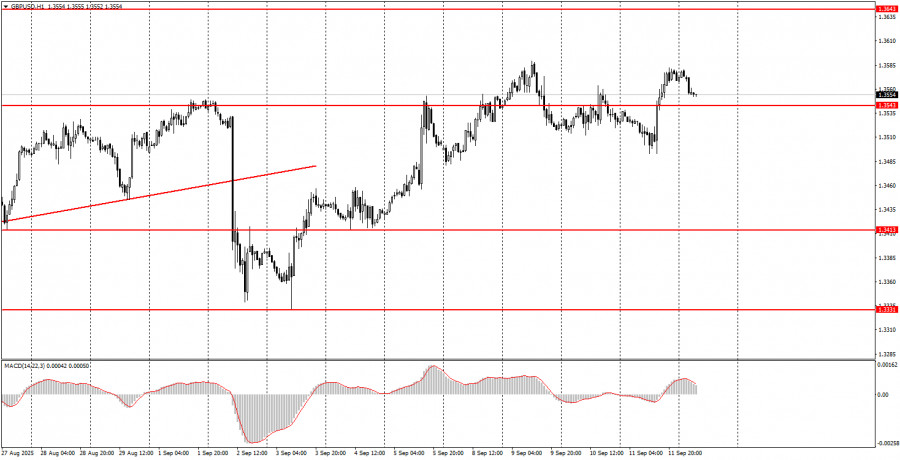

On the last trading day of the week, both currency pairs may resume upward movement, but new buy signals are needed for this. For the euro, a breakout above 1.1737–1.1745 will lead to further growth with a target of 1.1808. A bounce down from 1.1737–1.1745 allows for considering shorts, though substantial declines are not expected. For the pound, a bounce from 1.3529–1.3543 or a breakout above 1.3574–1.3590 makes long positions attractive, while a consolidation below 1.3529–1.3543 justifies shorts. In both cases, long positions remain preferable.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

QUICK LINKS