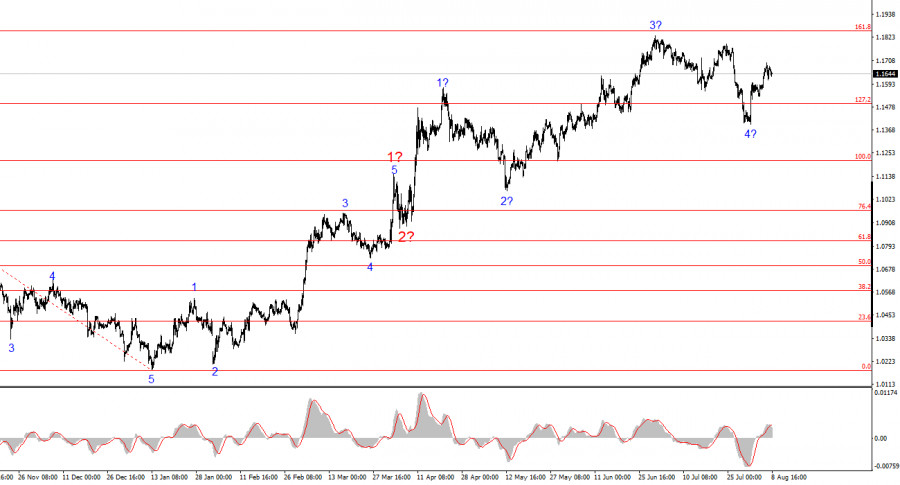

The wave pattern on the EUR/USD 4-hour chart has remained unchanged for several months, which is a very positive sign. Even when corrective waves are forming, the integrity of the structure is preserved. This allows for accurate forecasts. It is worth noting that wave patterns do not always look like textbook examples.

The formation of the upward section of the trend is continuing, while the news background mostly does not support the dollar. The trade war initiated by Donald Trump was intended to increase budget revenues and eliminate the trade deficit. However, these targets have not yet been achieved, while Trump's "One Big Law" will increase the U.S. national debt by 3 trillion dollars. The U.S. president continues to raise tariffs and introduce new ones. The market's assessment of Trump's first six months in office is very low, even though economic growth in the second quarter reached 3%.

At the moment, it can be assumed that the formation of wave 4 has been completed. If this is indeed the case, the construction of impulse wave 5 has begun, with potential targets extending up to the 1.25 level. Of course, the corrective structure of wave 4 could take a longer, five-wave form, but I am proceeding from the most likely scenario.

The EUR/USD rate edged slightly lower on Friday, with no news background at all. The world is closely following developments around a possible ceasefire between Ukraine and Russia. A personal meeting between Donald Trump, Vladimir Putin, and Volodymyr Zelensky could take place in the near future. The location has not yet been determined, but it would be the first meeting of this scale since the start of the military conflict in Ukraine. Many experts therefore believe that the conflict could be resolved in 2025.

After the meeting of the three leaders, lengthy negotiations are likely to begin. Officially, the positions of all parties are clear, but they will have to engage in dialogue and make compromises, which is not always feasible. For example, Donald Trump is not fond of compromises, but fortunately, his personal interest in the ceasefire issue is limited to the desire to establish peace and receive a Nobel Prize for it. In other words, America is not concerned with the terms on which Kyiv and Moscow reach an agreement, as long as peace is achieved.

Kyiv and Moscow, however, will have to make significant efforts to find at least some common ground. A few months ago, official meetings between the Russian and Ukrainian delegations began, but the demands put forward by both sides proved impractical. Several rounds of negotiations were held, during which the parties only agreed to continue talks and exchange prisoners. Naturally, such results were unsatisfactory, especially for Trump. As a result, the U.S. president began exerting pressure on both Kyiv and Moscow, which moved the process forward.

It should be noted that a ceasefire in Eastern Europe would boost demand for risk assets. Consequently, demand for the European currency could also increase. The wave pattern fully supports this scenario.

Based on the EUR/USD analysis, I conclude that the pair continues to form an upward section of the trend. The wave structure still largely depends on the news background related to Trump's decisions and U.S. foreign policy. The targets for this trend section could extend to the 1.25 level. Therefore, I continue to view buying opportunities with targets near 1.1875, which corresponds to the 161.8% Fibonacci level, and higher. The formation of wave 4 appears to be complete. Therefore, this is a good time to consider buying.

The main principles of my analysis:

QUICK LINKS