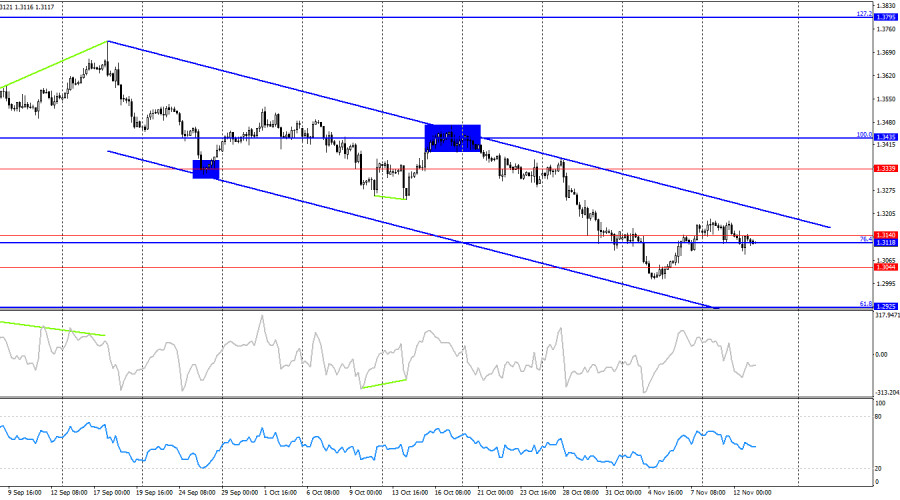

The wave structure remains bearish. The new upward wave failed to break the previous peak, while the latest downward wave (which formed over the past three weeks) broke the previous low. The news background in recent weeks has been negative for the U.S. dollar (in my view), but bullish traders have not taken advantage of the opportunities for an upward move. To complete the bearish trend, growth above 1.3470 or the formation of two consecutive bullish waves is required.

For the fourth consecutive day, the pound has been trading between 1.3110 and 1.3186. Traders have ignored nearly all the data and news released during the week. On Monday, they ignored Trump's announcement about the end of the "shutdown"; on Tuesday — the UK unemployment data (a minor reaction followed, but the sideways trend persisted); last night — the official end of the shutdown; and this morning — the UK GDP and industrial production figures.

The British economy showed only a 0.1% quarter-on-quarter GDP growth in the third quarter, even weaker than the most pessimistic forecasts. Industrial production performed even worse, contracting by 2% month-on-month versus traders' expectations of -0.2%. Thus, the pound could have long since consolidated below 1.3110 and continued to fall, as the U.S. has been releasing only positive data this week, while the UK continues to disappoint. Nevertheless, the bulls are holding their ground around the 1.3110 level and seem determined to mount another offensive.

On the 4-hour chart, the pair continues to decline within the descending trend channel. If a new bullish trend is beginning, we will gradually see confirmations of this. I will start considering a strong rise in the pound after the quotes close above the channel. A consolidation above 1.3140 allows us to expect continued growth of the pound. No emerging divergences are observed today.

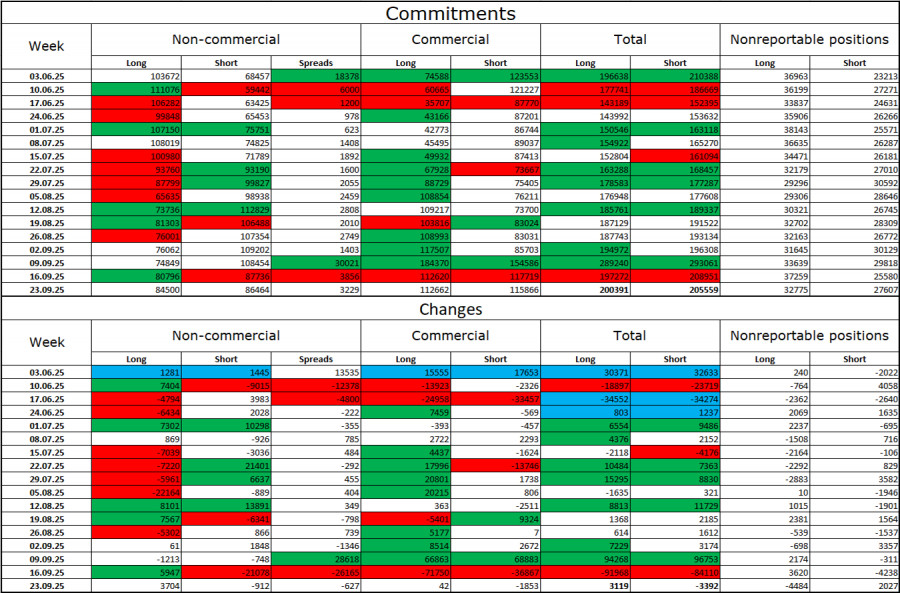

Commitments of Traders (COT) Report:

The sentiment among Non-commercial traders became more bullish in the latest reporting week — though that report is already a month and a half old. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The current spread between long and short positions stands roughly at 85,000 vs. 86,000, meaning bullish traders are again tipping the balance slightly in their favor.

In my view, the pound still faces downside risks; however, with each passing month, the U.S. dollar looks weaker and weaker. Whereas traders once worried about Donald Trump's protectionist policies without knowing their eventual consequences, now they fear those very consequences: a potential recession, constant imposition of new tariffs, and Trump's conflict with the Federal Reserve — which could make the regulator politically biased. Thus, the pound currently appears less risky than the U.S. currency.

News Calendar for the U.S. and the U.K.:

The economic calendar for November 13 includes two fairly important events. The news background will have little influence on market sentiment for the rest of the day.

GBP/USD Forecast and Trader Recommendations:

Sell positions may be considered today after the pair closes below the 1.3110–1.3139 level on the hourly chart, with a target of 1.3024, or after a rebound from 1.3186 with a target of 1.3110. Buy positions can be opened after a rebound from 1.3110, with targets at 1.3186 and 1.3247.

Fibonacci grids are built between 1.3247–1.3470 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.

ລິ້ງດ່ວນ