Trade Review and Recommendations for the Euro

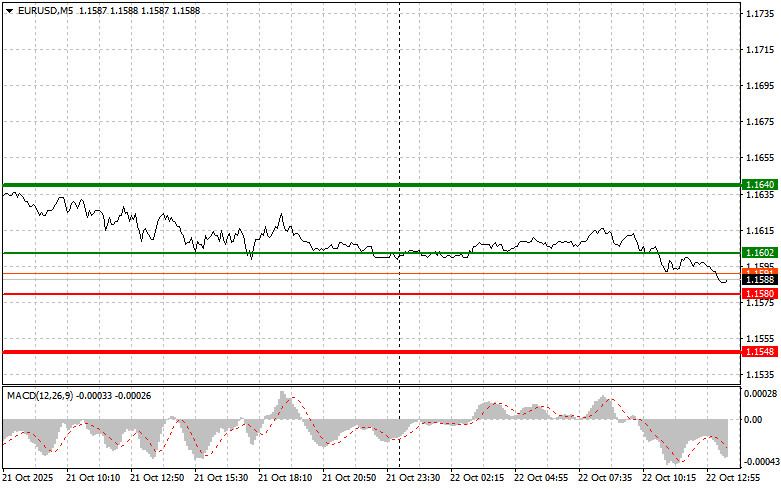

The price test of 1.1603 coincided with the moment when the MACD indicator had just started moving downward from the zero line, confirming the correct entry point for selling the euro. As a result, the pair fell by 15 points.

The decline of the euro against the U.S. dollar continues. With little fresh information to assess the state of the EU economy, investors are logically opting for a more reliable and predictable asset. The U.S. dollar, supported by a resilient economy, looks more attractive amid global instability. However, the lack of data is not the only reason behind the current trend. Market sentiment is shaped not only by current figures but also by expectations about future policy. In this area, the eurozone faces considerable challenges. Slowing economic growth, low inflation, and, surprisingly, a restrictive stance by the European Central Bank all create a difficult environment for traders.

This afternoon, only one member of the Federal Open Market Committee (FOMC) — Michael S. Barr — is scheduled to speak. Considering that the dollar has shown little reaction to dovish signals from the Federal Reserve, there appears to be little room for a significant euro rebound. It seems that the FX market has grown tired of constant hints about possible interest rate cuts and is now waiting for concrete action. Therefore, even if Barr unexpectedly takes a dovish tone, it is unlikely to have a notable impact on the euro's exchange rate.

As for intraday trading strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible near 1.1602 (green line on the chart) with a target at 1.1640. At 1.1640, I plan to exit the market and open a short position in the opposite direction, expecting a 30–35-point movement from the entry point. However, significant euro growth today is unlikely.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro if the price tests 1.1580 twice, while the MACD indicator is in the oversold zone. This should limit the pair's downward potential and trigger a reversal upward. A rise toward 1.1602 and 1.1640 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.1580 (red line on the chart). The target is 1.1548, where I plan to exit the market and immediately buy in the opposite direction, expecting a 20–25-point correction. Selling pressure on the pair could increase significantly today.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro if the price tests 1.1602 twice, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and likely lead to a reversal downward, with targets at 1.1580 and 1.1548.

Chart Legend

Important Note for Beginner Forex Traders

Beginner traders should be extremely cautious when deciding to enter the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss protection, you can quickly lose your entire deposit — especially if you ignore money management principles and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous decisions based on the current market situation are a losing strategy for an intraday trader.

ລິ້ງດ່ວນ