On Tuesday, the GBP/USD currency pair continued its upward movement. In the morning, the UK reports on unemployment and wages were published, but these only allowed traders to draw conclusions that had no impact on their trading decisions. For instance, the unemployment rate remained at 4.7%—what are we to conclude from that? Or the pace of wage growth slowed slightly (but stayed within forecasts)—what does that mean? Will the Bank of England take these figures and their results seriously?

In our view, the UK data package was utterly pointless. On Monday, there were no significant releases or events in either the US or the UK, yet the pound kept rising at the same rate all day. So these reports did not affect trader sentiment. We can't call them super-positive, but we can't call them negative either. But what about British inflation, which comes out this morning?

It doesn't matter anymore. What is the market looking at now? The ongoing trade war. The possibility that the Fed won't just cut rates a couple of times, but could start a whole easing cycle that ends with the rate at 1%. The fact that the Bank of England has no grounds to loosen policy in the near future. That means, regardless of whether August inflation is high or low, it's irrelevant.

Currently, the consumer price index is 3.8%. What can be said about this in September 2025? It's more than twice as high as it was in September 2024. Inflation has been rising for a whole year—this is a trend, not a shock reaction to Trump's tariffs. Inflation is almost double the target. If UK inflation slows this morning, what difference does it make? None, because it's still high. If it accelerates even more—what difference does it make? None, because it's still high. In any case, the Bank of England can no longer afford to cut rates. And since it can't, the pound gets additional reasons to keep rising.

If at least US macro stats were supportive for the dollar, we might expect the GBP/USD uptrend to pause a bit longer. However, US data continues to miss expectations, which fuels Trump's anger as he persists in blaming Powell & Co. If the Fed rate were lower, inflation would likely be even higher; however, business activity, GDP, NFP, industrial production, retail sales, and unemployment would also be lower. In other words, with a low rate, you'd have only one bad reading; with a high rate, everything is bad except GDP, which keeps climbing artificially.

No wonder Trump is putting pressure on the Fed, but so far, the US president isn't getting much out of this battle.

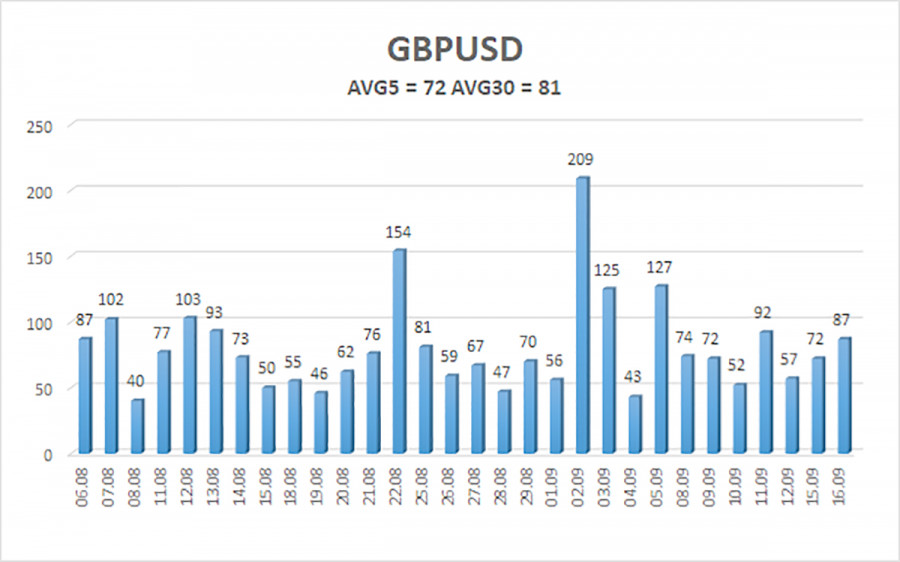

The average GBP/USD volatility over the last five trading days is 72 pips—a "medium" value for the pair. On Wednesday, September 17, we expect movement within the 1.3579–1.3723 range. The linear regression channel's upper band points upward, indicating a clear uptrend. The CCI indicator has again entered the oversold area, giving another alert of trend resumption.

S1 – 1.3611

S2 – 1.3550

S3 – 1.3489

R1 – 1.3672

R2 – 1.3733

R3 – 1.3794

The GBP/USD currency pair is again trying to continue its uptrend. In the medium term, Donald Trump's policy will likely continue to pressure the dollar, so we still do not expect dollar strength. Thus, long positions targeting 1.3723 and 1.3733 remain much more relevant if the price is above the moving average. If price drops below the moving average, small shorts are possible on purely technical grounds. Occasionally, the greenback makes corrections, but for a trend reversal, the dollar needs real evidence that the global trade war is over or other major positive factors.

ລິ້ງດ່ວນ