Trade Review and EUR/USD Strategy

The test of the 1.1732 level coincided with the MACD indicator having already moved significantly below the zero line, which limited the pair's downward potential. A second test of 1.1732 shortly thereafter occurred while MACD was in the oversold zone, confirming the conditions for Buy Scenario #2, but the pair failed to rise afterward.

Yesterday, the U.S. president stated his intention to continue with a strict tariff policy, which pressured the euro and supported the dollar. Trump ruled out granting new tariff exemptions to certain countries—likely including the EU—which triggered an immediate drop in the euro.

Today, during the first half of the day, the euro is likely to remain under pressure, as the only significant event in the eurozone is a speech by Bundesbank President Joachim Nagel. The market will closely monitor his remarks for clues on future monetary policy by the European Central Bank. Hawkish comments could support the euro, while a dovish tone would likely increase pressure on the currency.

As for the intraday strategy, I will focus primarily on implementing Buy Scenarios #1 and #2.

Buy Scenarios

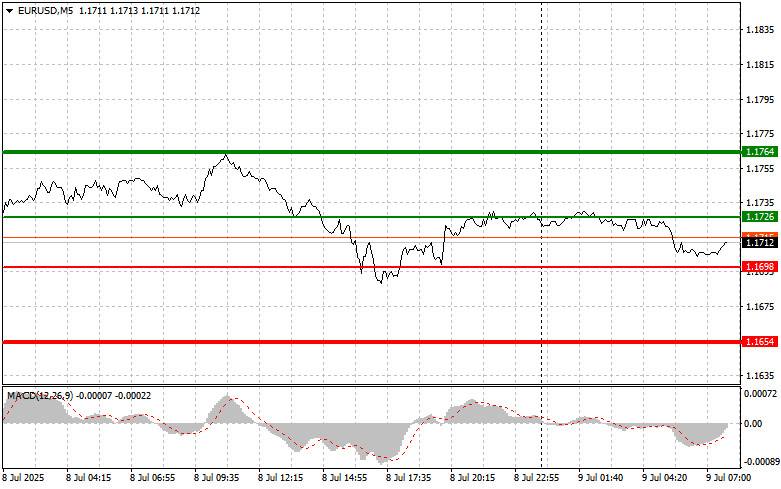

Scenario #1: I plan to buy the euro today if the price reaches the 1.1726 level (green line on the chart) with a target at 1.1764. At 1.1764, I plan to exit the market and initiate a short position in the opposite direction, aiming for a move of 30–35 points from the entry point. Today's euro gains, if any, are likely to be of a corrective nature. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.1698 twice in a row while the MACD indicator is in oversold territory. This would signal a limited downside and a likely reversal upward. In this case, targets would be 1.1726 and 1.1764.

Sell Scenarios

Scenario #1: I plan to sell the euro after the price reaches 1.1698 (red line on the chart). The target is 1.1654, where I plan to exit the market and initiate a buy trade in the opposite direction (expecting a 20–25 point retracement). Selling pressure on the pair is expected to persist today.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro if the price tests 1.1726 twice in a row while MACD is in the overbought zone. This would indicate limited upward potential and a possible reversal downward. In this case, a decline to 1.1698 and 1.1654 can be expected.

What's on the chart:

Important:Beginner forex traders should be extremely cautious when making trade entry decisions. It is best to stay out of the market before the release of important fundamental data to avoid being caught in sharp price swings. If you choose to trade during news events, always use stop-loss orders to limit potential losses. Without stop-losses, especially when trading large volumes without proper money management, you risk losing your entire deposit very quickly.

And remember: successful trading requires a clear plan—like the one outlined above. Making spontaneous trading decisions based on current market conditions is a losing strategy for intraday traders.

ລິ້ງດ່ວນ