On Monday, the GBP/USD pair also collapsed sharply, though it's more accurate to say the U.S. dollar showed strong growth. In recent months, virtually all market movements have been tied to the dollar. The dollar either rises or falls, while other currencies remain spectators in the drama called "Trump's New Trade Policy."

So if we start receiving more news about trade negotiations, trade deals, tariff reductions, and so on, the dollar could quickly return to its positions before its collapse two months ago. Besides Donald Trump and his trade aggression, what other reasons caused the dollar to fall? None. The U.S. economy remains strong, as Powell has stated, and the labor market shows no serious issues. Meanwhile, the European Central Bank and Bank of England continue to pursue monetary easing, while the Federal Reserve maintains a hawkish stance. However, the most crucial factor for the dollar is the continued de-escalation of the global trade war.

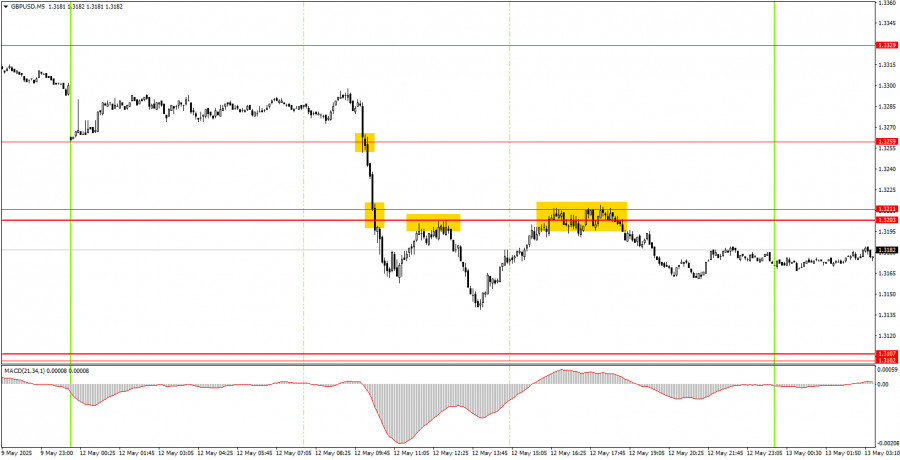

Four trading signals were generated on Monday on the 5-minute timeframe, none of which could have led to losses. Short positions could have been opened as early as the break below 1.3259. Then, the price breached the 1.3203–1.3211 area and returned to it twice. In each case, the price rebounded from the area, giving novice traders opportunities to open new short positions. The 1.3102–1.3107 zone wasn't reached, but overall, the day ended with solid profits.

On the hourly timeframe, GBP/USD continues to follow Trump-related news, which now means that the British pound is falling while the dollar is rising. Even the U.S.–UK trade agreement benefits the dollar more than the pound, since the dollar was the one falling on every tariff and sanctions headline. Now, the dollar should strengthen with each piece of news regarding the de-escalation of the trade war.

On Tuesday, GBP/USD may continue to decline, as the news of U.S.–China mutual understanding is a major and influential development. Its impact could extend beyond a single day. From a technical perspective, a downtrend has begun on the hourly chart.

On the 5-minute chart, you can trade the following levels: 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329, 1.3365, 1.3421–1.3440, 1.3488, 1.3537, 1.3580–1.3598. On Tuesday, the UK will release significant unemployment and wage growth reports, and the U.S. will publish an even more important inflation report. We believe that UK data will not significantly impact the pound, but the inflation figures could be a market mover.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

ລິ້ງດ່ວນ