Geopolitical shocks trigger spikes in equity market volatility. However, for such events to affect corporate profits, the conflicts need to be long?lasting. In the case of Venezuela, investors did not see that. The US operation to abduct President Nicolas Maduro took place without fanfare, and Caracas is ready to cooperate with Washington. That means it is reasonable to buy the S&P 500.

Donald Trump's pledge to send US drilling rigs to restore oil production in the country propelled US oil stocks higher. That sector, together with technology, pushed equity indices up. Thanks to the energy rally, the Dow Jones posted its first record high of the new year.

S&P 500 Forecasts and Dynamics

Wall Street experts expect the S&P 500 to rise by 9% in 2026. That is less than the 24%, 23% and 16% recorded in 2023, 2024, and 2025, respectively. The consensus estimate is roughly equal to the average annual return of the broad index in the 21st century. It also matches the average gain in the fourth year of a bull market. If forecasts materialize, it would be the best multi?year performance for the S&P 500 since 1999.

However, history is less rosy. Three consecutive double?digit rallies in the broad index were followed by pullbacks in 2015 and 2022. How will it play out this time?

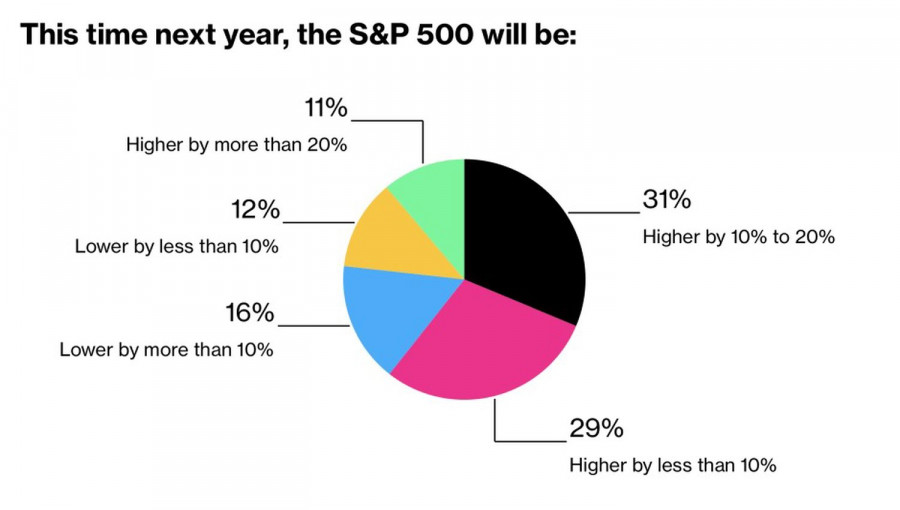

Investors are optimistic. 71% of respondents in the MLIV Pulse expect the S&P 500 to jump by at least 10% in 2026. Eleven percent forecast gains of 20% or more.

Investor Forecasts for S&P 500

Much will depend on US labor market data for December. Bloomberg analysts expect employment to rise by 60,000 and unemployment to fall to 4.5%.

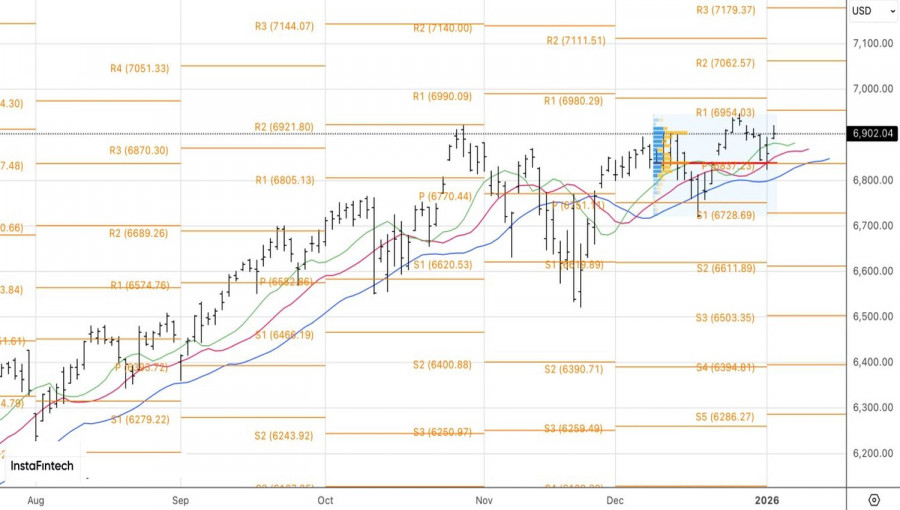

Technically, the daily chart shows that the bears' inability to keep the broad index below the fair value at 6,840 signaled their weakness and allowed traders to go long. A break above the resistance level of 6,925 would make it possible to add to long positions.