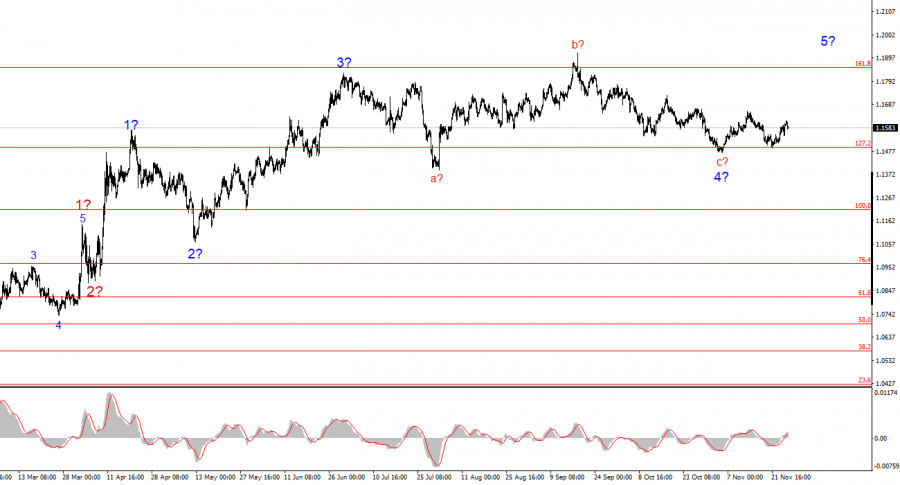

The 4-hour wave pattern for EUR/USD has changed but still looks fairly clear. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure since July 1 has become significantly more complex and extended. In my view, the instrument has completed the formation of corrective wave 4, which has taken an unconventional form. Inside this wave, we observe exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

In my opinion, the formation of the upward trend segment is not finished, and its targets extend all the way to the 1.25 level. The series of waves a-b-c-d-e appears complete; therefore, in the coming weeks I expect the formation of a new upward wave sequence. We have already seen the assumed waves 1 and 2, and the instrument is currently forming wave 3 or c. I expected the second wave to end in the 38.2%–61.8% Fibonacci retracement level of wave 1, but the quotes dipped to 76.4%. Over the past few days, everything has been moving according to plan.

The EUR/USD rate slightly weakened on Thursday toward the beginning of the U.S. session, but in my view, this is simply a pullback. There was no significant news in either the EU or the U.S. during the first half of the day; only the German consumer confidence index was released, and it matched market expectations exactly. Therefore, this index could not have caused the decline of the euro — nor the decline of the British pound alongside it.

The end of November is turning out to be quite dull in terms of news, but I want to remind you that over the past two months the market has repeatedly ignored important reports. I still do not understand how the market managed to interpret the U.S. government "shutdown" as positive, for example. Analysts have also already forgotten that the U.S. government and federal agencies were essentially on leave for a month and a half. Everyone seems to have forgotten this — just as they have forgotten about the two rounds of Federal Reserve monetary easing and the third one that is on the horizon. In recent days, EUR/USD has been rising, but what we need is not just a rise, but a fully formed upward wave sequence.

In December, U.S. economic statistics for October and November will begin to appear, and this may be where the dollar runs into trouble. It is obvious that many economic indicators will decline due to the month-and-a-half shutdown. Most of the attention will go to Nonfarm Payrolls and the unemployment rate, and these also have every chance of disappointing. I still expect a strong fall in the U.S. currency, and the wave structure continues to support this scenario.

Based on the EUR/USD analysis, I conclude that the instrument continues forming an upward trend segment. Over the past few months, the market has taken a pause, but the policies of Donald Trump and the Federal Reserve remain significant factors that could lead to a decline in the U.S. currency in the future. The targets for the current trend segment may extend up to the 1.25 level. At the moment, the formation of an upward wave sequence may continue. I expect wave 3 of this sequence (or wave c) to continue developing from current levels, with targets near 1.1740. I remain in long positions with these targets in mind.

At a smaller scale, the entire upward trend segment is visible. The wave pattern is not the most standard one, as the corrective waves are of different sizes. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. Let me remind you that it is best to identify clear, understandable structures on charts rather than obsessively assigning labels to every wave. At the moment, the upward structure raises no doubts.

The Main Principles of My Analysis: